How Does Moving Jobs Affect Your Mortgage Application?

Before you apply for a mortgage, you should consider whether moving jobs will affect your loan. Most lenders do not look negatively upon a change of employment, but if you are changing jobs in the middle of a loan, it may be a red flag for the lender. It’s especially bad if your new job is lower-paying or in a more unstable industry. However, if your income has not dropped significantly because of a new job, it shouldn’t be a concern.

When moving jobs, you must notify your lender as soon as possible. In addition, you should gather all the necessary documentation. You will want to submit copies of your pay stubs and tax returns, as well as a new employment contract. Make sure to bring the new employment contract to your lender, even if you haven’t yet started your new position. Having all of this ready will help you get approved quickly.

Another example of a job change is an offer letter. Bill wants to accept the new job he’s been offered, but he will need a new mortgage when his new job is finished two months from now. He worries that changing jobs will affect the mortgage application process, as the lender will need his offer letter and pay stub from his new job. Pat is also changing jobs, but she wants to buy a home as soon as possible, and is concerned about how this will affect her mortgage application.

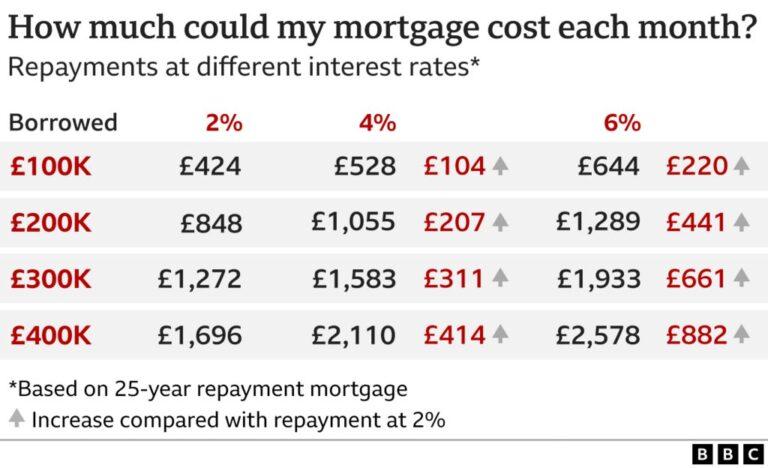

Changing jobs while buying a home is a major red flag for mortgage lenders, but if you make the switch before applying for a mortgage, it should have less effect. Lenders will look at your employment history and income carefully, so it is important to have a stable and reliable income. Moving from a lower-paying job to a higher-paying one can cause considerable changes in your mortgage payments.

While moving jobs for a new job can be an uphill battle, it shouldn’t be a big issue if you have the equivalent or higher income. Documenting your employment history is the best way to prove your new income and employment history. Changing jobs shouldn’t negatively affect your loan application if you can show proof that your new job will not affect your income.

Lenders consider age, income, credit history, and profession when making a mortgage application. Long gaps in employment can also be a red flag for lenders. If the gap in employment is less than three months, your mortgage application is more likely to be approved. However, full-time students entering the workforce or veterans returning home from the military are exceptions to this rule.

For example, a high school sports coach may be a good candidate for a mortgage because he or she has been in the position for more than a decade. Since the Federal Housing Administration backs FHA mortgages, lenders tend to view career changes as acceptable if they make sense. If a new job offers a better pay structure, consider waiting until after closing before relocating.