The Basics For First Time Home Buyers

Buying your first home is an exciting time but also a big financial commitment. We’re here to help you make the most of it with our guide.

One of the biggest mistakes first time home buyers make is spending more money on their house than they can afford. Avoid this by making sure you’re paying off debt and saving up for a down payment.

Credit Score

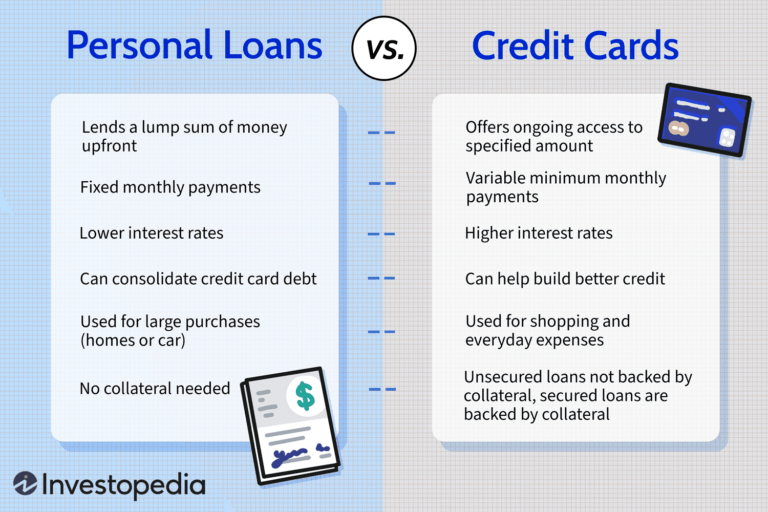

Your credit score (often called a FICO Score) is an important factor when lenders decide whether to approve your mortgage application. A good score means a lender will likely offer you a better interest rate and loan terms than someone with less-than-optimal credit.

Your score is a number that ranges from 300 to 850, with a score of 740 or higher considered very good. It isn’t necessary to have a high credit score to buy a home, though.

Your credit history is a big part of your score, but there are other factors that are also considered. For example, your debt-to-income ratio and employment history may influence a lender’s decision to approve your mortgage application.

Down Payment

One of the most challenging challenges for many first time homebuyers is saving for a down payment. Especially for those who don’t have profits from selling their previous home, it can be very difficult to come up with enough money to buy their first home.

Fortunately, there are several down payment assistance programs available nationwide. These include special loans, tax credits, and grants specifically designed to help first time buyers get into their homes.

For example, the Down Payment Assistance Program (DPA) offered by Bank of America is a mortgage loan that can be combined with down payment grants and forgivable second-lien loans to cover a buyer’s down payment and closing costs.

These loans can be used on single-family homes, condos, co-ops and manufactured homes. They also offer competitive mortgage rates and flexible eligibility requirements. In addition, DPA can help you avoid the expense of private mortgage insurance (PMI). Lastly, it can be a good way to get into your dream home with minimal out-of-pocket cash.

Mortgage Rates

Mortgage rates are a significant element of the home buying process. They may vary based on several factors, such as the economy, unemployment and the number of new jobs being created.

If you’re a first time buyer, it’s wise to get pre-approved for a mortgage before you start house hunting. This will give you a sense of how much home you can afford and allow you to make a savings plan for your down payment and closing costs.

Ideally, you want to save enough for a 20% down payment. This will help you avoid private mortgage insurance (PMI) and prevent you from paying tens of thousands of dollars in interest over the life of your loan.

You can also qualify for government-backed loans, such as FHA and USDA, which have low down payment requirements and less restrictive credit score guidelines than conventional loans. For example, you can buy a home with an FHA loan with a credit score as low as 580, though this depends on the lender and type of loan.

Property Taxes

One of the many expenses that first time home buyers have to deal with is property taxes. These are levied on the value of real estate and can vary widely from state to state, so it’s important to understand what you’re getting into before you buy a new house.

In addition to the standard property tax you’ll pay at closing, there are several other deductions that first time homeowners can take advantage of, such as mortgage interest and certain improvements to your home. You may also qualify for tax credits and exemptions, which can help lower your taxes even more.