Did you know that 48% of first-time homebuyers in 2023 weren’t aware of the minimum credit score requirements for mortgages? I’ve spent over 15 years as a mortgage advisor, and I can tell you that understanding credit score requirements is crucial for anyone looking to buy a home in 2024. Whether you’re aiming for a conventional loan or considering an FHA mortgage, your credit score plays a pivotal role in not just approval, but also in determining your interest rate and monthly payments.

I remember working with a client last year who was absolutely convinced she couldn’t get a mortgage because her credit score was in the mid-600s. She was ready to give up on her dream of homeownership! But here’s the thing – there are actually multiple mortgage options available across different credit score ranges. Let me break down exactly what you need to know about credit scores and mortgages in 2024.

Minimum Credit Scores by Mortgage Type

Let’s get right to the numbers you’re looking for. Through my years of experience, I’ve helped clients with various credit profiles secure different types of mortgages. Here’s what you need to know about each loan type:

FHA loans continue to be the most flexible option in 2024. The minimum credit score requirement is 580 if you’re planning to make the minimum 3.5% down payment. I’ve actually helped several clients with scores between 500-579 qualify for FHA loans, though they needed to put 10% down. One thing that surprises many of my clients is that these are just FHA guidelines – individual lenders might set their own minimums slightly higher, typically around 620.

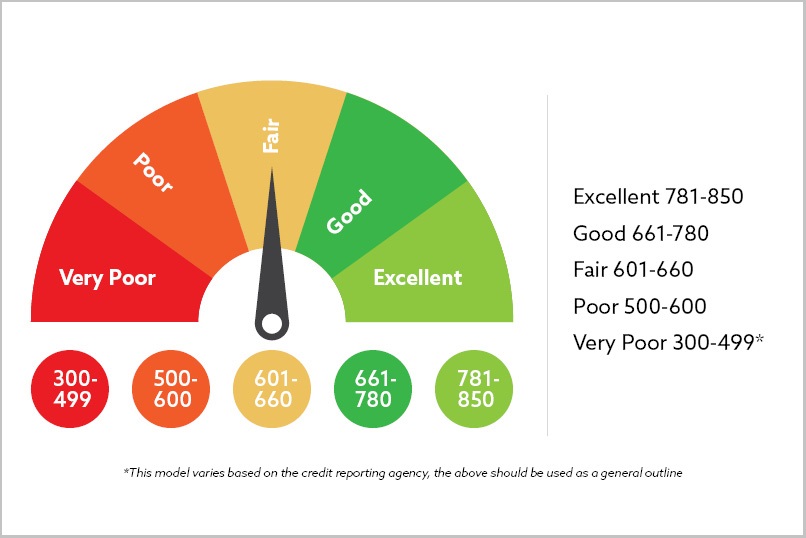

Conventional loans backed by Fannie Mae and Freddie Mac generally require a minimum credit score of 620. However, I always tell my clients that scoring at least 660 will give them much better chances of approval and significantly better rates. For example, I recently worked with a borrower whose rate dropped by 0.5% when they improved their score from 620 to 680!

How Credit Scores Affect Mortgage Rates

This is where things get really interesting – and expensive! I always show my clients a rate comparison chart because the impact of credit scores on interest rates can be eye-opening. Let’s look at the current rates for a $300,000 conventional loan across different credit score ranges. As you can see in the chart below, the difference in rates is quite significant:

2024 Mortgage Interest Rates by Credit Score

* Rates shown are examples based on a $300,000 conventional loan with 20% down payment.

Actual rates may vary based on market conditions and other factors.

That might not look like much, but let me tell you – on a $300,000 loan, the difference between a 6.25% and 7.5% rate is about $250 per month! That’s $3,000 per year or $90,000 over a 30-year term. Pretty significant, right?

Beyond the Credit Score: Other Factors That Matter

Here’s something that took me years to fully appreciate – credit scores are just one piece of the puzzle. I’ve seen clients with 750 credit scores get denied and others with 630 scores get approved. Why? Because other factors can make or break your application:

Debt-to-income ratio is arguably just as important as your credit score. In 2024, most lenders want to see a DTI below 43%, though some programs may go higher. I always tell my clients to aim for 36% or lower for the best chances of approval.

Employment history is crucial. You generally need two years of consistent income, though there are exceptions for new graduates or career changes within the same field. One of my recent clients was worried because she had switched jobs six months before applying, but since she stayed in the same industry and got a higher salary, it wasn’t an issue.

Improving Your Credit Score for Mortgage Approval

Want to know the fastest way to boost your credit score for a mortgage? I’ll share what’s worked best for my clients:

First, focus on credit utilization. I had a client who raised her score by 45 points in just two months by paying down her credit cards to below 30% utilization. Some even saw improvements within a single billing cycle!

Avoid opening new credit accounts. I can’t tell you how many times I’ve seen clients apply for a new car loan or credit card while preparing for a mortgage, only to watch their scores drop 15-20 points.

Special Mortgage Programs for Lower Credit Scores

There are some fantastic options available if your credit score isn’t where you’d like it to be. Portfolio lenders, who keep loans on their own books, often offer more flexibility. I’ve worked with several who will go down to 580 for well-qualified borrowers with strong income and assets.

Non-QM loans are another option, though they typically come with higher rates. These can be particularly useful for self-employed borrowers or those with unique income situations.

Getting Approved with a Co-Borrower

Adding a co-borrower can be a game-changer, but it needs to be done right. Here’s what you need to know:

For conventional loans, lenders typically use the lower of the two credit scores. However, FHA loans are more flexible, using the lower of the two middle scores. I recently worked with a couple where one had a 720 score and the other a 640 – we went with an FHA loan because the conventional loan pricing would have been based solely on the 640.

Conclusion

After helping hundreds of families secure mortgages, I can tell you that while credit scores are important, they’re not everything. Yes, a higher score will get you better rates and more options. But if your score isn’t perfect, don’t give up on your homeownership dreams! Take time to review your credit report, work on improvements where needed, and consult with multiple lenders to find the best fit for your situation.

Remember, the mortgage market is constantly evolving, and requirements can vary significantly between lenders. What matters most is finding the right program and lender for your specific situation. And hey, if you’re not quite ready for a mortgage today, that’s okay too – use this time to build your credit and strengthen your financial profile. Your future self will thank you!