What Is a Mortgage With Points?

You might be asking: what is a mortgage with points? Points are mortgage fees that lenders charge for the privilege of selling you a mortgage at a lower rate. Buying points can make your loan more affordable, but you must be sure to stay in the home long enough to recoup those costs. Mortgage calculators can help you calculate how many points you need to pay per month to make them worthwhile. Listed below are some benefits and disadvantages of mortgage points.

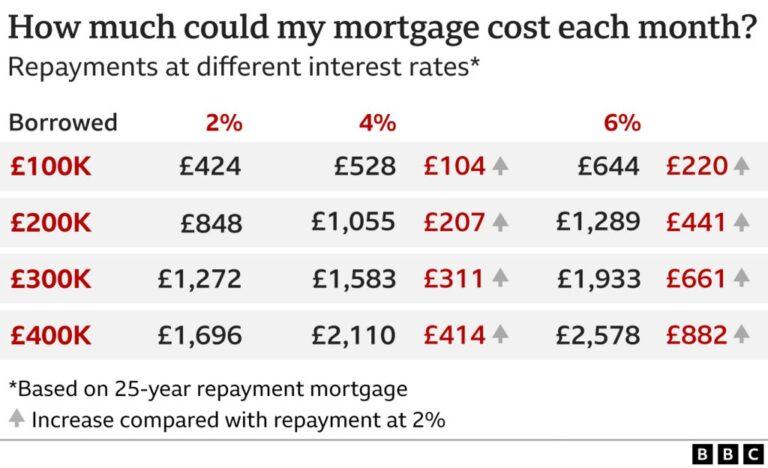

A mortgage with points will lower your interest rate by 0.25%, although this reduction can vary from lender to lender, and market conditions. Always run your numbers to find out what points you will need to get the lowest rate possible. Even if you’re paying extra for points, you should still compare mortgage offers from competing lenders. Whether your mortgage has points is worth the extra expense, or not, a higher rate is still better than no points at all.

Points are tax deductible. If you itemize your deductions, the points are tax-deductible. However, the amount of points you pay may be limited to your loan’s term. However, they can lower your interest rate and enable you to put a higher down payment on your home. So it’s worth checking to see if you can qualify for tax deductions on mortgage points before you start applying for a mortgage.

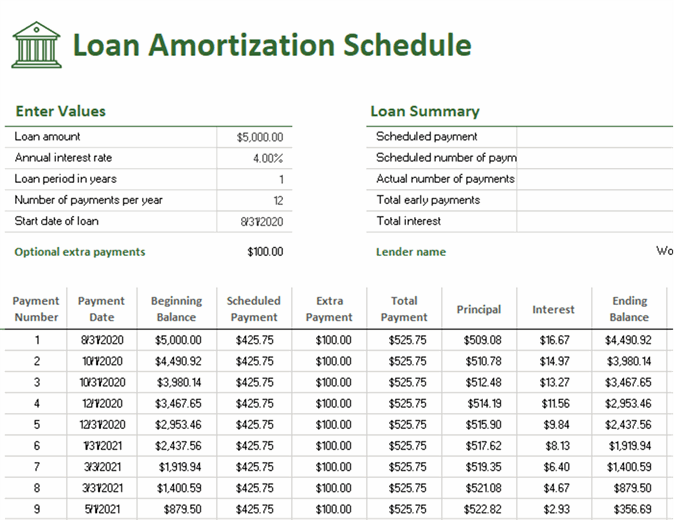

Mortgage points cost 1% of the total loan amount. Each point reduces your interest rate by 0.25%. The amount of points you need depends on your lender, but it is typically around one percent. Points will be listed on your official closing disclosure, so it’s important to understand them and choose the right amount to spend. In general, you can buy one to three points, depending on your needs and budget. There is no maximum number of points you can buy, and many lenders allow you to buy fractional amounts of points.

Generally, the more points you pay for your mortgage, the lower your rate will be. In general, you’ll pay off your mortgage faster if you buy points instead of discount points. You can’t deduct mortgage points in your first year, but you can deduct them over the life of the loan. There’s also an exception that lets you deduct the entire amount in the year of payment. However, it’s best to avoid paying points for your mortgage if you don’t have a lot of savings on your current rate.

When you buy points for your mortgage, you can negotiate a lower interest rate. Each point equals one percent of the loan amount. Therefore, one point on a $300,000 loan would cost you $3,000 if you want to pay less for your loan. However, keep in mind that the Consumer Financial Protection Bureau (CFPB) has laws that prohibit lenders from using mortgage points to boost their interest rates. Buying points means paying some extra money upfront, but the lower interest rate will last for the entire duration of your loan.