Is the Toronto Real Estate Market Going to Crash?

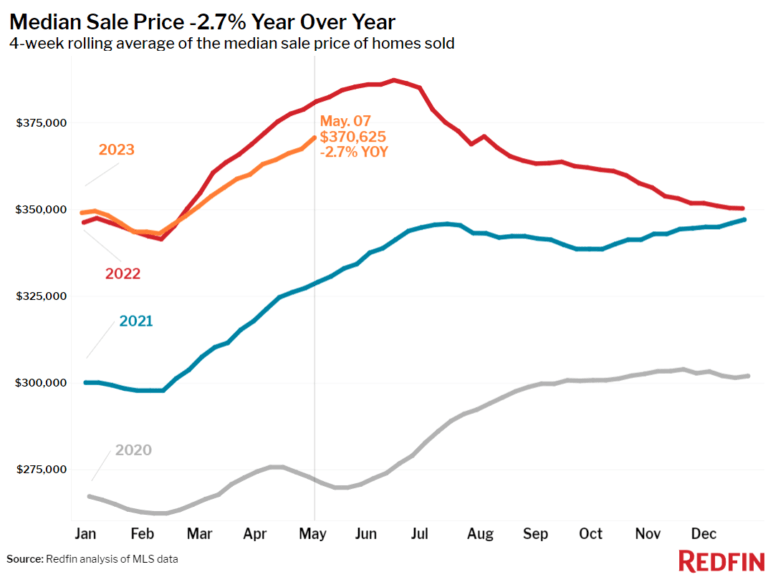

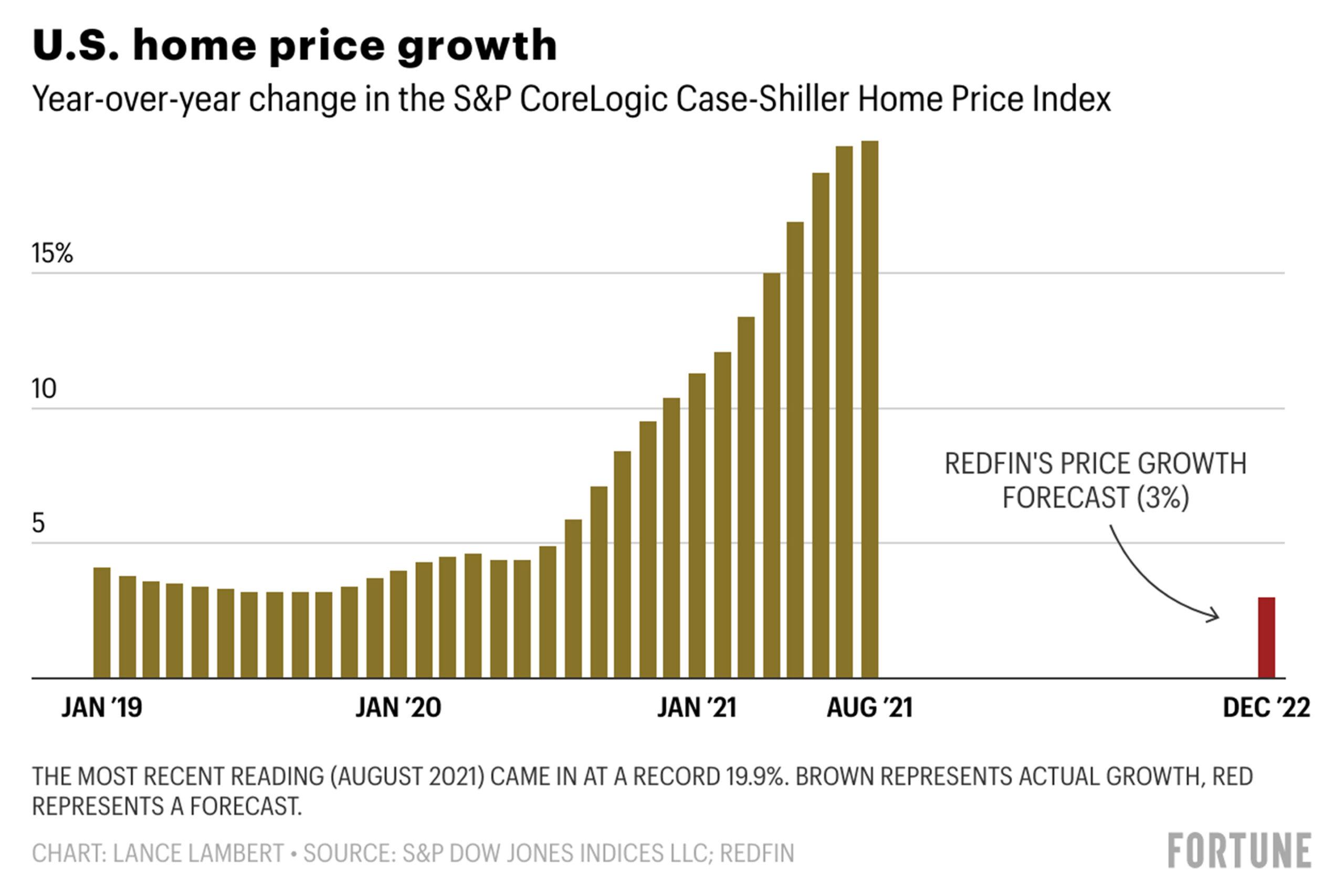

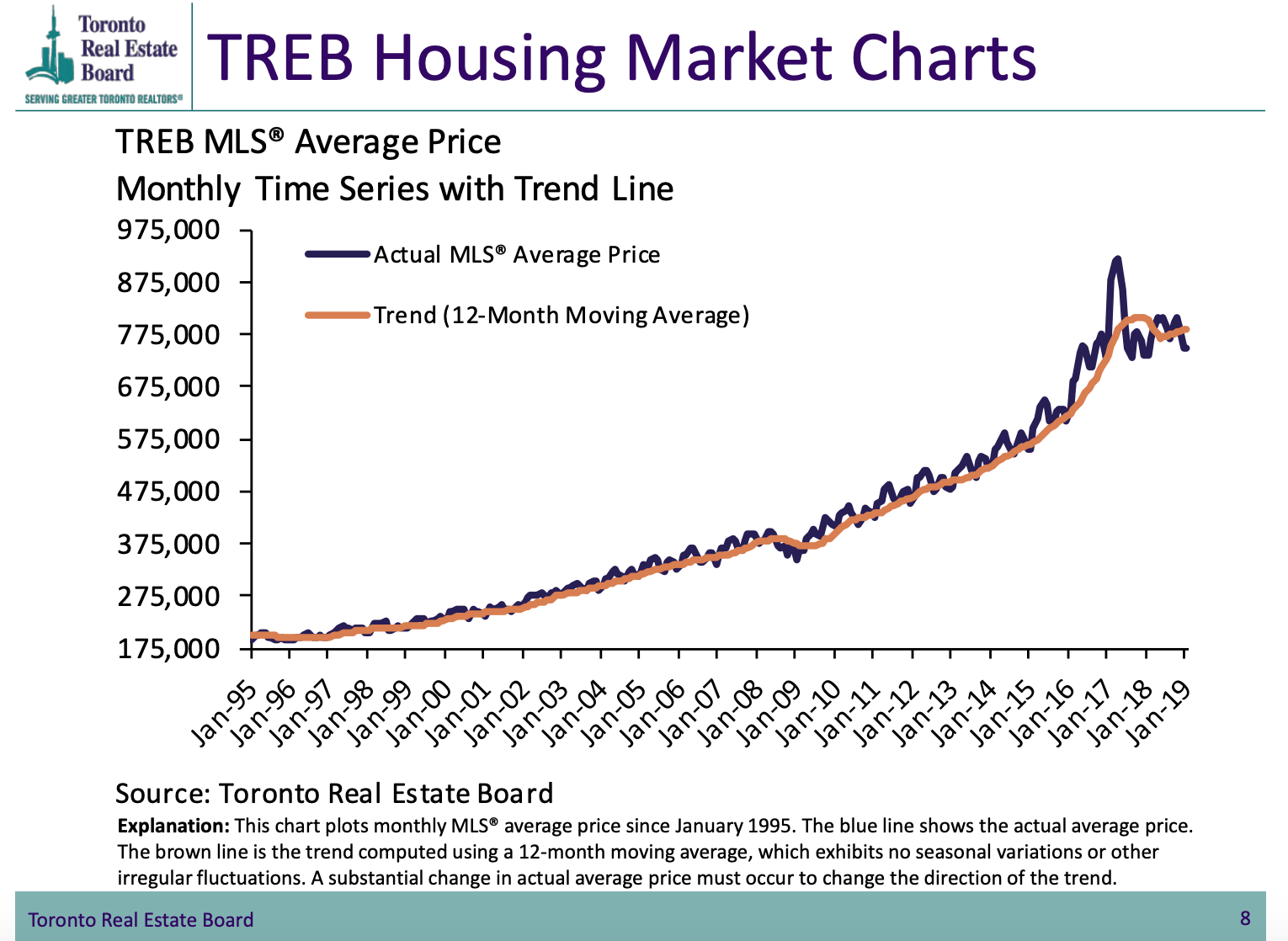

The question of is the Toronto real estate market going to crash is a legitimate one. While we’re not experiencing a crash at the moment, the housing market has been on a roller coaster for years. Prices have gone from very affordable to incredibly unaffordable. The worst-case scenario of a 30% to 40% drop would still leave the market where it was before the pandemic began. In addition, if the housing market was to crash, the fallout would be limited to the price of homes and condos.

There are many reasons why the market may be prone to a crash. First of all, a global recession could raise interest rates globally, which would further increase the cost of borrowing. Second, a crash would drain the luck of first-time buyers. However, if we’re talking about a soft landing, then the housing market in Toronto will most likely rebound. A soft landing would mean a recovery in a number of areas, including Toronto.

Despite all the predictions of a Toronto housing crash, the current economy is still growing far beyond the capacity of young adults to afford homes. And although the Toronto real estate market is likely to continue to rise, the economic situation in the US may make speculators less prepared.