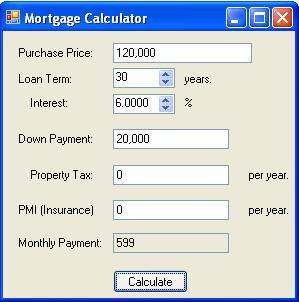

When you use the mortgage Zillow calculator, you can figure out your payment for any house you’re interested in. You’ll be required to input the down payment, mortgage interest rate, and loan term. You can change these later if necessary. The calculator also lets you know your payments, including taxes, homeowners insurance, and HOA fees. Once you have these numbers, you can see how much you’ll have to pay every month on your mortgage.

It auto-populates the average interest rate

Mortgage rates have been on the decline since the Federal Reserve first lowered interest rates after the coronavirus pandemic, and the calculator will auto-populate the current average interest rate. To make sure you aren’t paying more than you have to, you should consider how much down payment you can afford and what your monthly payments should be. The calculator will also auto-populate the average interest rate and allow you to customize your results.

The mortgage calculator also allows you to enter expenses related to PMI, property taxes, homeowners insurance, and HOA fees, all of which can affect your monthly payments. Unlike some other mortgage calculators, the Zillow mortgage calculator defaults to the full range of PITI (property tax, homeowners insurance, and PMI).

It ignores HOA dues

Is it possible that Zillow’s mortgage calculator is misreading my HOA dues? This may be the case, but I tried both methods anyway and found that Zillow underestimated HOA dues by nearly 50 percent. Compared to Redfin, my HOA dues were automatically pulled from the property listing. The latter seems to lowball mortgage rates, but Redfin does seem to be the most accurate option at the moment.

When you include all the costs, your mortgage payment is nearly 50% higher than the previous figure. Is it possible that Zillow ignores HOA dues in its mortgage calculator? Let’s find out! We used the mortgage calculator on Zillow to check the costs involved in home ownership. However, we’re able to make an informed decision with the help of Zillow’s mortgage calculator.

It ignores PMI

It’s important to note that Zillow mortgage calculators don’t account for private mortgage insurance (PMI) if you make a 20% down payment. Instead, Zillow calculates PMI at half a percent and adjusts the number for your loan amount and down payment. The numbers provided by Zillow are estimates and can vary from reality. Whether or not PMI is applied to your mortgage will depend on the actual circumstances of your loan.

If you don’t have enough money to pay 20% down, you may want to consider a loan with lower monthly payments. Generally, you’ll want to pay at least 20% down to avoid paying PMI. For those who don’t want to pay this much, a spreadsheet will allow you to make changes to the minimum percentage. This will give you an idea of the amount you’ll need to pay yearly in order to avoid PMI.

It assumes user knows a little about mortgages

The generic Zillow mortgage calculator asks for your home’s value, loan amount, interest rate, and start date. It will assume that you know something about mortgages, and will factor in things like property taxes and PMI, which can throw off the numbers. Hopefully, you’ll have some background knowledge to understand how mortgages work before trying one of these calculators.

It is designed for FHA loans

You can use the Zillow mortgage calculator to estimate your monthly payments. The first step is to enter some basic information, such as the home price and down payment amount. Once you have entered this information, the calculator will calculate your estimated monthly payment and repayment schedule. You can make adjustments at any point and see how much your payments will change over time. After all, there are many factors that affect your monthly payments, so a mortgage calculator is a great tool for determining your payments.

One of the most important factors in calculating your monthly mortgage payments is your debt-to-income ratio (DTI). The DTI is a measure that helps mortgage lenders determine how much money you can afford to borrow. A higher DTI indicates that you’re unlikely to qualify for a mortgage. In most cases, a DTI of 43% or less is required. For that reason, using the Zillow mortgage calculator is a good way to calculate your payment based on your actual financial situation.

It is not 100% accurate

While the Zillow mortgage calculator does a decent job of estimating the monthly payment, it isn’t 100 percent accurate. If you’re considering a home purchase, you should know that the full payment is the sum of all your monthly expenses, including taxes, homeowners insurance, and HOA dues. Using this calculator only for a ballpark figure isn’t a good idea.

The calculator’s interface looks very neat and easy to use. It also promises to give you an estimate of your total mortgage payment. It’s easy to navigate and lists everything you need to know. This includes interest, principal, taxes, insurance, homeowners association fees, and private mortgage insurance. The mortgage payment also includes 1.2 percent of the property tax. You might think that the Zillow mortgage calculator is accurate, but it’s not.