Whether you’re looking to buy a home or refinance your current loan, you’ve likely been wondering about rates for mortgages. Whether you’re interested in fixed-rate mortgages, adjustable-rate mortgages, or Federal funds rate loans, there are several things to consider. Read on to learn more. Until then, you should be aware of the basics of variable-rate mortgages and refinancing rates.

Variable-rate mortgages

A variable-rate mortgage is a loan that fluctuates in rate based on an index. This index reflects the cost of borrowing from the credit markets by the lender. Variable-rate mortgages may be offered at a lender’s standard variable rate or at an index that is higher or lower than the lending institution’s standard variable rate. It is best to research a variable-rate mortgage before signing on the dotted line.

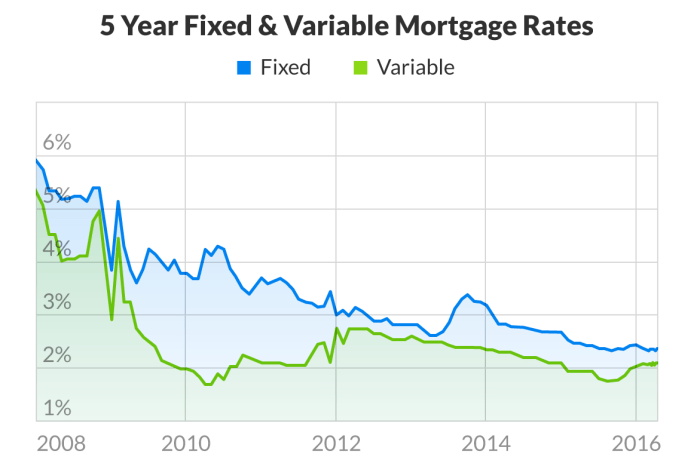

A variable-rate mortgage is an alternative to a fixed-rate mortgage. However, it is important to note that a variable-rate mortgage can result in higher interest costs throughout the life of the loan. The initial rate may be lower, but once the variable period begins, the interest rate may increase. This can be a significant issue, so it is wise to shop around for the best mortgage deal. This way, you can avoid paying more than you can afford to.

Another difference between a fixed-rate mortgage and a variable-rate mortgage is their end dates. For a fixed-rate mortgage, the end date is fixed, while a variable-rate mortgage ends at the end of the term. This means that you won’t be paying a penalty if you choose to repay your mortgage early. Alternatively, if you’re willing to take a longer-term loan, you can choose to switch to a variable-rate mortgage with no exit fees. However, you will need to do your sums carefully before deciding to apply for a variable-rate mortgage.

Refinance rates

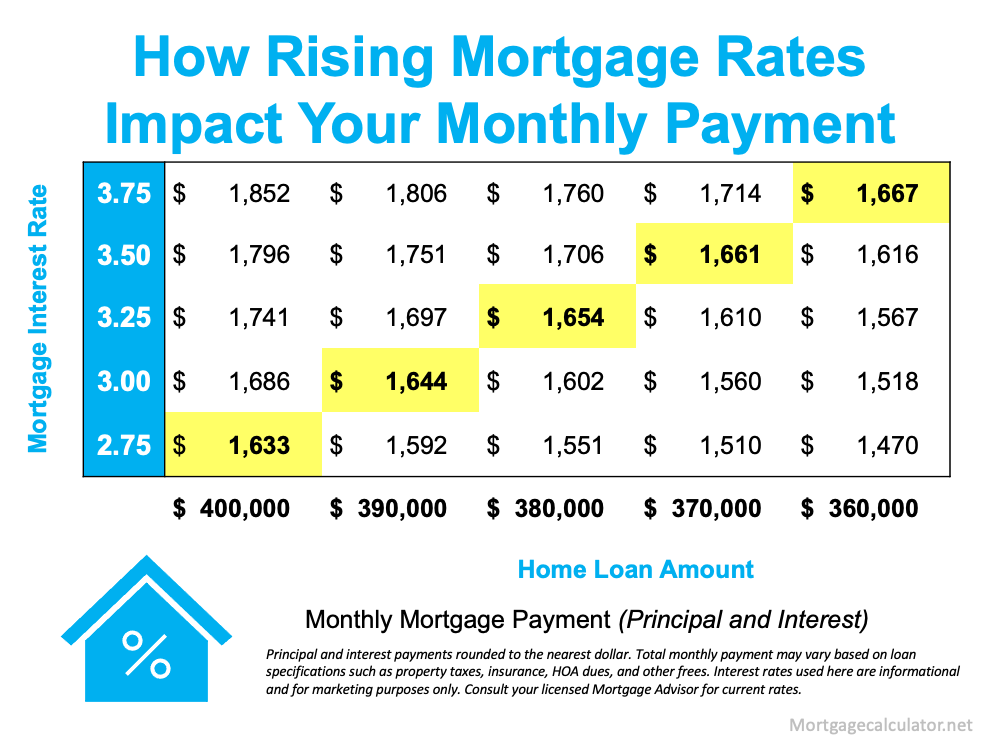

If you’ve been paying higher interest rates on your mortgage than you’d like to, refinancing your loan might be the best option. Refinancing rates depend on many factors, including your credit score, property value, and loan amount. Getting a lower rate can mean substantial savings, but you should also think about the fees associated with refinancing, such as the closing costs. A refinance can be a beneficial option for you if you’ve been making on-time payments for several years.

However, fewer people can actually save money by refinancing their mortgage. According to Black Knight, a mortgage technology and data provider, “there are a small group of high-quality refinance candidates who can save at least a quarter of their current loan balance.” These homeowners typically have a 30-year mortgage with a loan-to-value ratio (LTV) of at least 80%, a credit score of 720 or higher, and a credit rating of at least 620. Most of these individuals have mortgages that were taken out before the housing crash.

While interest rates on mortgages are on the rise, they remain historically low. Shop around for the best rates and lenders to suit your needs. A great lender may be the Better Mortgage, but shop around as well to make sure you’re getting the best rate. For more information, visit the Better Mortgage website. So, get ready for a competitive loan refinancing experience. It’s never too early to start saving!

Federal funds rate

The Federal Reserve’s short-term interest rate (or the federal funds rate) plays an important role in determining mortgage rates and other credit card APRs. The rate was recently increased by a quarter-point, as market expectations called for. Since the Fed’s last increase, mortgage rates have risen steadily through the month of April. And this trend is likely to continue, with markets expecting several more hikes this year.

While the Federal Reserve doesn’t directly set mortgage rates, the Fed’s actions are closely monitored by key players in the mortgage industry, and the direction of their decisions affects mortgage rates. The Fed announced that it would increase the federal funds rate by half-a-point in May, and more increases are expected by the end of the year. Mortgage rates typically move in tandem with Fed policy, although they sometimes move in opposite directions. This is because of the uncertainty associated with a Fed rate increase, especially one that’s based on the short-term Federal Funds rate.

The Federal Open Market Committee meets eight times a year. They meet more frequently if necessary, such as during the 2008-2011 recession or when the U.S. government failed to raise the debt ceiling. Some people think that the Federal Reserve makes consumer mortgage rates, but the fact is that it is Wall Street that sets mortgage rates. There’s no single bank making these decisions. The Fed does meet in an emergency situation, and the rates can be as low as 0.75%.