The FICO Score is a number that represents your credit worthiness. It is calculated from information in your credit report and is based on factors like the length of time you have had credit and the amount of credit you’ve used. This information helps lenders make smarter decisions when approving credit. Fortunately, there are some things you can do to help your FICO Score. To start, you should avoid too much debt and make payments on time.

Keeping your overall credit utilization below 30%

One of the most crucial components of a good FICO score is keeping your overall credit utilization below 30%. Experts suggest that you should never use more than 30 percent of the available credit on your card. This applies to the total balance on all your cards and to each individual card. Although this percentage can seem high, it is actually a relatively small number that you can work with and improve your FICO score.

You can also raise your credit limit. By increasing your credit limit to a higher number, you can help your credit utilization ratio. If you have a credit card with a $5,000 limit, you will use about 60 percent of that limit. On the other hand, if you have a credit card with a $10,000 limit, you will only use 30 percent of the total available credit.

One way to keep your credit utilization low is to pay more than you borrow. You can do this by paying more than you spend each billing cycle. If you’re struggling to keep your credit utilization ratio below 30%, you can try using free services like NerdWallet to help you track your credit usage.

Making on-time payments

Making on-time payments is important for a good FICO score. These payments are reported to the three consumer credit bureaus on or before the due date. Although it may be frustrating to miss a payment, many lenders give late-payers a grace period of up to 29 days. If you make your payment during this grace period, it will be reported as on-time.

Credit scores are calculated using information from your payment history, which accounts for 35% of your credit score. This information tells the lender whether you’ve made payments on time and how often. The more on-time payments you make, the better your score will be. On the other hand, late payments can damage your credit score and make you appear more risky to lenders.

The best way to recover from a poor payment history is to continue making on-time payments for at least two years. After that, your credit score will recover. In the meantime, you should focus on avoiding paying more than 30 days past due on any of your credit accounts. While it takes time to build a good credit history, it is possible to significantly improve your FICO score with proper planning and good habits.

Keeping your credit utilization below 30%

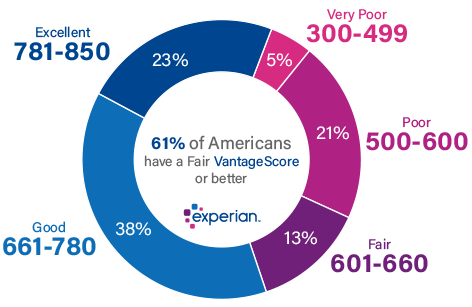

Many experts say that a credit utilization ratio of less than 30% is desirable. However, the exact impact on your FICO Score depends on your credit profile as a whole. According to VantageScore, an individual who uses credit cards at a 30 percent utilization rate receives a higher score than one with a higher utilization rate.

Whether you have several revolving credit cards or only one, it is important to keep the ratio of all your accounts at less than 30%. This ratio will depend on the type of account you have and the amount of debt you have. If your credit card usage is more than 30%, your FICO score will suffer. Fortunately, there are some simple steps you can take to avoid this problem.

Another way to improve your score is to make timely payments on your credit cards. Making a substantial payment every month will help you lower your credit utilization rate. However, it won’t immediately boost your score.

Soft inquiries

Soft inquiries show the same information as hard inquiries, including the amount of debt in collections and payment history. Some financial institutions can access this information by requesting a soft inquiry, such as when applying for a new insurance policy. Debt-settlement companies may also share this information with creditors. The most common reason to conduct soft inquiries is to monitor your own credit report. You can use a credit monitoring service to pull soft inquiries for you on a weekly or monthly basis.

While these inquiries do not negatively affect your score, it’s important to limit the number you make. A single inquiry from a credit card company isn’t going to have a major impact on your score, but multiple inquiries from rate shoppers are. Also, if you’re applying for a loan to buy a house, submitting several applications will count as one inquiry.

If you’re looking for a new credit card, a soft inquiry may be the answer. This kind of inquiry helps a lender evaluate whether you’re a good risk for a credit card. It won’t impact your score, but it’s worth checking your report regularly to detect mistakes and prevent identity theft. Soft inquiries can also occur when you apply for a loan, receive an insurance quote, or apply for preapproval. However, it’s important to note that the number of inquiries you have will vary from report to report.