Housing market crash

The housing market crash is a significant event that had a profound impact on the global economy. It refers to a sudden and severe decline in the prices of houses, leading to a decrease in housing sales and an increase in foreclosure rates. Let’s take a closer look at what caused this crash and its implications.

Overview of the housing market crash and its impact

The housing market crash, which peaked in 2008, was primarily triggered by the bursting of the housing bubble in the United States. This bubble was formed due to the rapid increase in housing prices, driven by lax lending standards and an abundance of subprime mortgages. As a result, people were buying homes they couldn’t afford, leading to an oversupply of houses.

When the bubble burst, the housing market crashed, causing a significant decline in housing prices and an increase in foreclosures. This had far-reaching consequences, including a severe impact on the financial sector, a decrease in consumer spending, and a recession that affected economies worldwide.

Factors leading to the housing market crash

Several factors contributed to the housing market crash. These include:

- Subprime lending: Banks and financial institutions provided loans to borrowers with low creditworthiness, often with adjustable interest rates. When these rates increased, many borrowers could no longer afford their mortgage payments, leading to foreclosures.

- Housing speculation: Investors bought properties with the anticipation of quick profits, driving up housing prices artificially.

- Securitization and subprime mortgage-backed securities: Risky mortgages were bundled together and sold as complex financial instruments, spreading the risk through the financial system and leading to the collapse of large institutions.

- Regulatory failures: Government policies and oversight were insufficient to prevent risky lending practices and curb excessive speculation.

The housing market crash served as a stark reminder of the importance of responsible lending practices, effective regulation, and the need for a stable housing market to ensure the overall stability of the economy.

Pre-Crash Warning Signs

In the years leading up to the housing market crash, several warning signs emerged that indicated trouble ahead. If you were paying attention, you may have noticed these signs and taken steps to protect yourself. Here are two key warning signs that were prevalent before the crash.

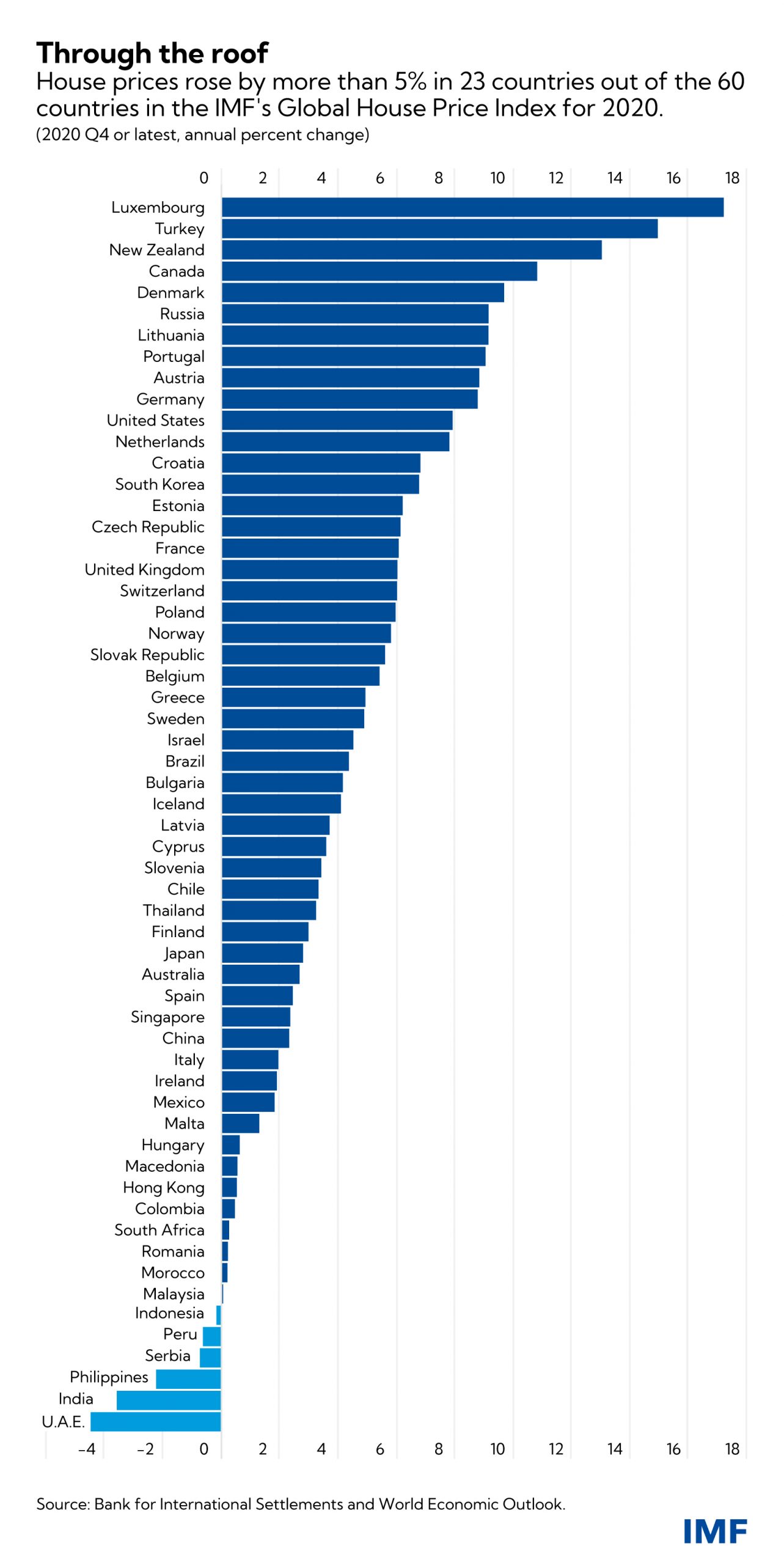

Increasing housing prices and unaffordability

Prior to the crash, housing prices were skyrocketing, making homeownership increasingly unaffordable for many people. The rapid rise in prices was not sustainable and created a housing bubble that would eventually burst. Many potential buyers were forced to take on risky loans or stretch their budgets to purchase a home, setting the stage for future financial instability.

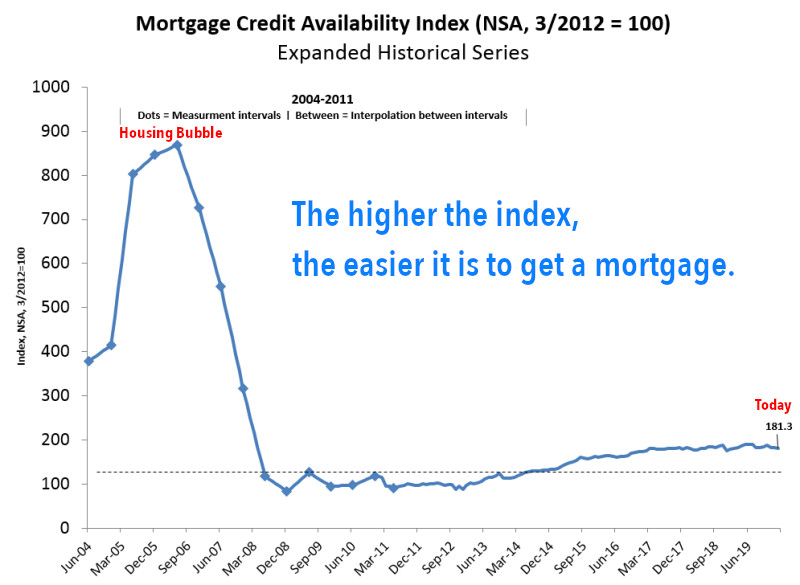

Rise in subprime mortgage lending

Another warning sign was the significant increase in subprime mortgage lending. Banks and other financial institutions were granting mortgages to borrowers with lower credit scores and higher risk profiles. These loans typically had higher interest rates and less favorable terms. As the number of subprime mortgages increased, so did the overall risk in the housing market, setting the stage for a wave of defaults and foreclosures when the market eventually crashed.

By being aware of these warning signs, individuals and institutions could have taken steps to mitigate their exposure to the housing market crash. However, many did not anticipate the severity of the crisis that would follow.

Causes of the Housing Market Crash

Deregulation and lax lending practices

The housing market crash of [insert year] was not an isolated event but the result of various contributing factors. One of the main causes was deregulation and lax lending practices within the financial industry. In an attempt to encourage homeownership, regulations were relaxed, allowing for easier access to mortgage loans. This led to an increase in lending to borrowers who may not have been able to afford it, resulting in high-risk mortgages being issued.

Collapse of the subprime mortgage market

Another significant cause of the housing market crash was the collapse of the subprime mortgage market. Subprime mortgages are loans given to borrowers with low credit scores or limited credit history. These loans became increasingly popular, leading to a rise in housing demand and inflated home prices. However, when many borrowers failed to repay their loans, the subprime mortgage market collapsed. This triggered a chain reaction, causing housing prices to plummet and resulting in widespread foreclosures.

The combination of deregulation, lax lending practices, and the collapse of the subprime mortgage market created a perfect storm that ultimately led to the housing market crash. It serves as a stark reminder of the importance of responsible lending practices and the need for effective regulations to safeguard the stability of the housing market.

Effects of the Housing Market Crash

Foreclosures and decline in home values

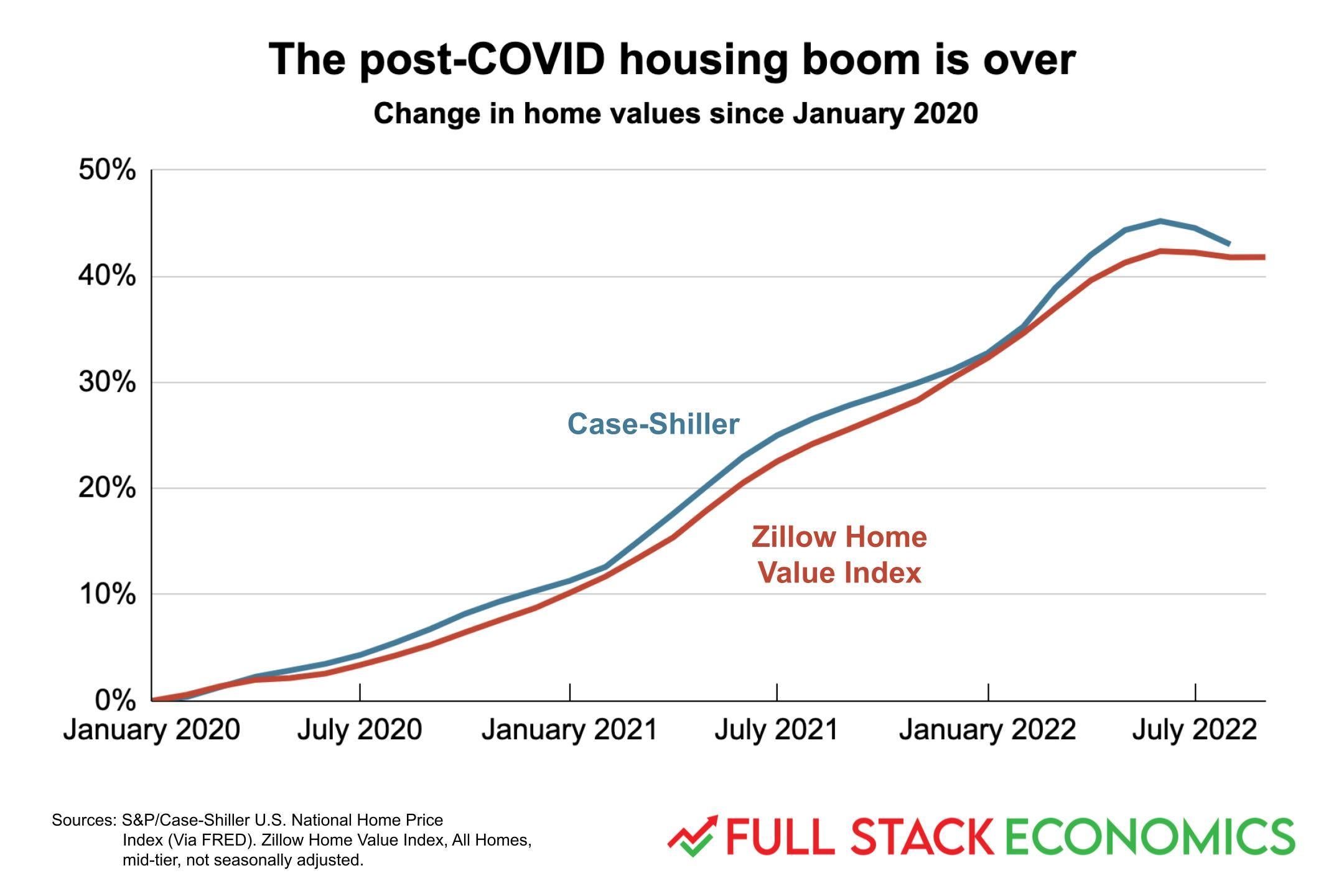

The housing market crash has far-reaching consequences, and one of the major effects is an increase in foreclosures and a decline in home values. When the housing bubble burst, many homeowners found themselves unable to meet their mortgage payments, leading to a rise in foreclosures. This flood of foreclosed properties in the market resulted in an oversupply, which caused home prices to plummet.

As a result, many homeowners found themselves in a situation where they owed more on their mortgages than their homes were worth. This negative equity made it challenging for them to sell their homes or refinance their loans. The decline in home values also affected the overall economy, as it reduced homeowners’ net worth and diminished consumer spending.

Financial crisis and economic recession

The housing market crash played a significant role in triggering the 2008 financial crisis and subsequent economic recession. The collapse of the housing market affected financial institutions that held mortgage-backed securities, many of which were tied to subprime mortgages.

As these mortgage securities lost value, financial institutions faced substantial losses, leading to a crisis of confidence in the banking system. This crisis extended beyond financial markets and resulted in a severe economic downturn, with widespread job losses, reduced consumer spending, and a contraction of credit availability.

The effects of the housing market crash on the economy were long-lasting, requiring substantial government intervention and efforts to stabilize the housing market and restore economic growth.

Recovery and Lessons Learned

Government intervention and housing market stabilization

In the aftermath of the housing market crash, the government took action to stabilize the market and prevent a similar collapse in the future. One key intervention was the implementation of various stimulus packages and policies aimed at supporting homeowners and boosting the housing industry. These measures included programs that offered mortgage assistance, foreclosure prevention initiatives, and incentives for first-time homebuyers. Through these interventions, the government hoped to restore confidence in the housing market and encourage economic recovery.

Regulatory reforms and stricter lending standards

The housing market crash also brought about significant regulatory reforms and stricter lending standards. Financial institutions faced increased scrutiny and regulations to prevent risky lending practices that had contributed to the crisis. The Dodd-Frank Wall Street Reform and Consumer Protection Act was passed, imposing more stringent regulations on the banking industry. Stricter lending standards were implemented to ensure borrowers had the ability to repay their mortgages. These reforms aimed to create a more stable and sustainable housing market, with greater transparency and accountability.

Overall, the housing market crash served as a wake-up call for both the government and financial institutions. The recovery efforts and regulatory reforms put in place aimed to prevent a similar crisis from occurring again, while also emphasizing the importance of responsible lending practices and the need for consumer protection in the housing market. By learning from the mistakes of the past, the industry has taken steps towards a more stable and secure housing market.

Impact on Homeowners and Communities

Loss of wealth and economic hardship

The housing market crash can have a devastating impact on homeowners and communities alike. One of the most immediate and significant consequences is the loss of wealth. As home values plummet, homeowners may find themselves owing more on their mortgages than what their homes are worth. This can lead to foreclosure and financial distress, as homeowners struggle to pay their debts and maintain their homes. The resulting economic hardship can have ripple effects on the local economy, including decreased consumer spending and job losses in industries related to housing and construction.

Long-term effects on neighborhoods and housing stability

The impact of a housing market crash extends beyond individual homeowners. Communities can experience a decline in property values, which can affect overall neighborhood stability. Vacant and abandoned properties may become more prevalent, leading to increased crime rates and decreased quality of life. Additionally, the lack of affordable housing options can exacerbate housing inequality and put pressure on already vulnerable populations. It can take years, if not decades, for neighborhoods and communities to recover from the effects of a housing market crash, making it crucial for policymakers and stakeholders to implement measures that promote housing stability and mitigate the long-term impacts.

Conclusion

The housing market crash had a significant impact on the economy and the lives of many individuals. It resulted in a decline in housing prices, foreclosures, and a decrease in consumer spending. The effects of the crash were felt across various sectors, leading to a global financial crisis.

Analysis of the housing market crash and its lasting effects

The housing market crash was primarily caused by factors such as risky lending practices, the bursting of the housing bubble, and a decrease in consumer confidence. The crash led to a decrease in homeownership rates, an increase in rental demand, and a slowdown in new home construction. Furthermore, it contributed to the collapse of various financial institutions and increased unemployment rates.

Future outlook for the housing market and lessons to be learned

Since the housing market crash, there have been efforts to stabilize the housing market and prevent similar crises from occurring in the future. Regulatory reforms have been implemented to enhance oversight and prevent risky lending practices. However, it is important to remain cautious and vigilant, as the housing market remains susceptible to fluctuations.

Lessons learned from the housing market crash include the importance of responsible lending practices, the need for transparent and accurate information for homebuyers, and the significance of monitoring market conditions. By understanding the factors that led to the crash and implementing appropriate measures, it is possible to avoid a similar crisis in the future.