Introduction

Overview of mortgage payments in the USA

As we enter 2023, it is important to understand the current landscape of mortgage payments in the USA. For many Americans, purchasing a home is a significant milestone, but it often comes with the responsibility of monthly mortgage payments. These payments, which consist of both principal and interest, play a crucial role in homeownership.

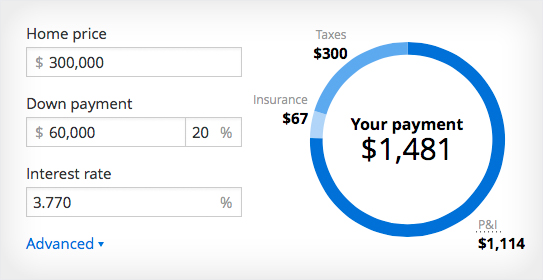

The average mortgage payment in the USA can vary based on several factors, including the loan amount, interest rate, and repayment term. According to recent data, the median monthly mortgage payment for homeowners across the country is approximately $1,500. However, it is important to note that this figure can vary significantly depending on the location and the specific circumstances of the borrower.

The housing market conditions, such as supply and demand, can also impact mortgage payments. In recent years, low-interest rates and favorable market conditions have made homeownership more affordable for many Americans. However, it is always advisable to carefully analyze your financial situation and consult with a mortgage professional before making such a significant commitment.

It is also worth mentioning that mortgage payments do not solely consist of principal and interest. Additional costs, such as property taxes, homeowner’s insurance, and private mortgage insurance (if applicable), can add to the overall financial obligation.

In conclusion, understanding the average mortgage payment in the USA is crucial for anyone considering homeownership. It is essential to carefully evaluate your financial situation, explore different mortgage options, and seek professional advice to ensure that you can comfortably afford the monthly payments and maintain a stable financial future

Factors Affecting Mortgage Payments

Interest rates and economic conditions

The average mortgage payment in the USA can be significantly influenced by interest rates and economic conditions. When interest rates are low, borrowers can secure mortgages with lower rates, resulting in more affordable monthly payments. Conversely, higher interest rates can increase monthly mortgage payments, making homeownership less accessible for some individuals. Economic conditions, such as inflation, job market stability, and overall economic growth, can also impact mortgage rates, which in turn affect monthly payments.

Loan duration and type

The duration and type of loan chosen by borrowers also play a significant role in mortgage payments. Generally, longer-term loans, such as a 30-year mortgage, have lower monthly payments but result in higher overall interest payments over the life of the loan. On the other hand, shorter-term loans, like a 15-year mortgage, have higher monthly payments but allow borrowers to pay off their mortgage faster and save on interest costs. Additionally, the type of loan chosen, such as fixed-rate or adjustable-rate mortgages, can also affect monthly payments. Fixed-rate mortgages provide the stability of consistent monthly payments throughout the loan term, while adjustable-rate mortgages may offer lower initial payments but can fluctuate over time.

It is important to note that these factors are just some of the key elements that influence mortgage payments. Other factors, such as the borrower’s credit score, down payment amount, and property tax rates, also contribute to the overall affordability of monthly mortgage payments.

Aspiring homeowners should carefully consider these factors and evaluate their financial situation to determine a realistic budget and ensure they can comfortably afford their mortgage payments. Consulting with a mortgage professional can provide valuable insights and guidance to make informed decisions about homeownership.

Average Mortgage Payment in the USA

National average mortgage payment

The average mortgage payment in the USA can vary depending on several factors, including interest rates, loan duration, and economic conditions. As of 2023, the national average monthly mortgage payment is influenced by current interest rates and economic factors. When interest rates are low, borrowers can secure mortgages with lower rates, resulting in more affordable monthly payments. Conversely, higher interest rates can increase monthly mortgage payments, making homeownership less accessible for some individuals.

The average mortgage payment also depends on the duration and type of loan chosen by borrowers. Longer-term loans, such as a 30-year mortgage, generally have lower monthly payments but result in higher overall interest payments over the life of the loan. On the other hand, shorter-term loans, like a 15-year mortgage, have higher monthly payments but allow borrowers to pay off their mortgage faster and save on interest costs.

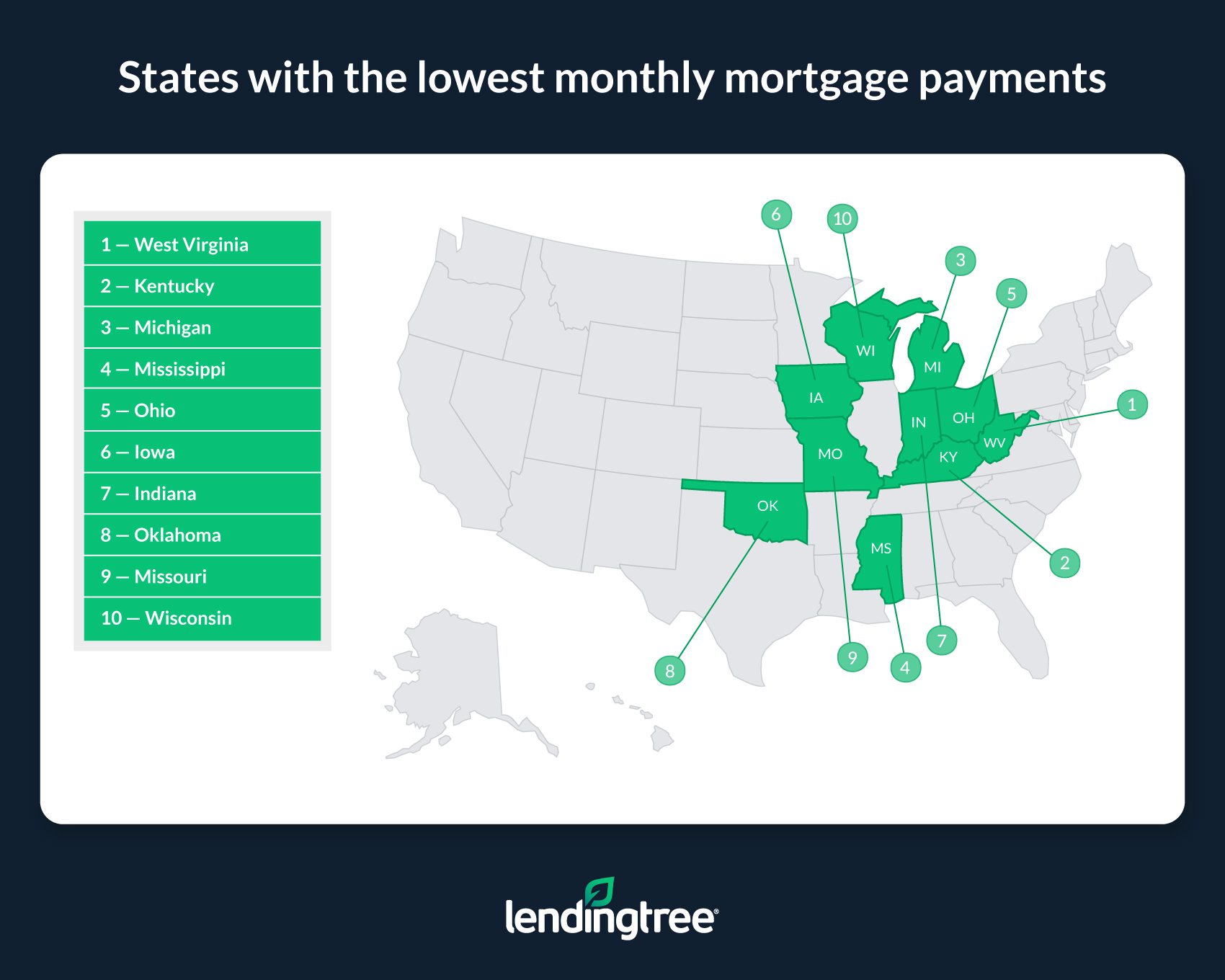

Regional variations in mortgage payments

It is important to note that mortgage payments can also vary by region within the USA. Factors such as housing prices, property tax rates, and local economic conditions can influence the affordability of homeownership in different areas. For example, cities with higher housing prices may have larger mortgage payments compared to rural areas with lower housing costs. Additionally, property tax rates can vary widely across different states and can impact the overall cost of homeownership.

Aspiring homeowners should carefully consider these factors and evaluate their financial situation to determine a realistic budget and ensure they can comfortably afford their mortgage payments. Consulting with a mortgage professional can provide valuable insights and guidance to make informed decisions about homeownership.

Affordability and Affordability Index

Determining how much you can afford

When it comes to homeownership, one of the crucial factors to consider is affordability. Determining how much you can afford is important to ensure that your monthly mortgage payment fits comfortably within your budget. Here are a few key points to consider:

- Calculate your income and expenses: Start by assessing your monthly income and existing expenses. This will give you a clearer idea of how much you can allocate towards your mortgage payment.

- Consider the 28/36 rule: As a general guideline, your monthly mortgage payment should not exceed 28% of your gross monthly income. Additionally, your total debt, including your mortgage, should not exceed 36% of your gross monthly income.

- Factor in other costs: Apart from the mortgage payment, consider other homeownership costs, such as property taxes, homeowners insurance, and maintenance expenses. Be sure to include these in your budgeting calculations.

Affordability index and its significance

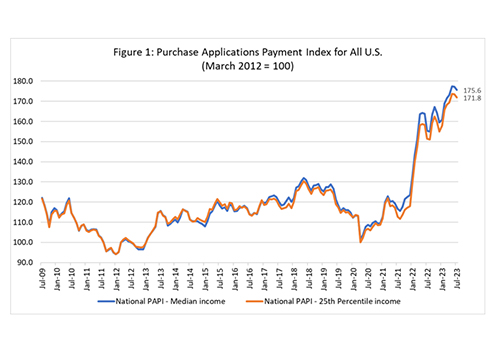

Understanding the affordability index can provide valuable insights into the housing market and the potential impact on your monthly mortgage payment. The affordability index measures the relationship between median household income and median home prices in a specific area.

A higher affordability index indicates that housing is more affordable, while a lower index suggests higher housing costs relative to income levels. By considering the affordability index, you can gauge whether housing in a particular area suits your financial capabilities.

It’s important to note that the affordability index can vary across regions. Factors such as local economic conditions and housing supply and demand can influence affordability. Keep in mind that while the national average mortgage payment provides a generalized estimate, regional variations can significantly impact your personal mortgage payment.

Consulting with a mortgage professional can provide valuable guidance on understanding the local housing market, exploring mortgage options, and determining an affordable mortgage payment that aligns with your financial goals and circumstances.

Strategies to Lower Mortgage Payments

Refinancing options

Refinancing your mortgage is one strategy that can help lower your monthly mortgage payment. By refinancing, you can take advantage of lower interest rates or extend the loan term to reduce your monthly payment. With favorable market conditions, refinancing can lead to significant savings over the life of your loan. However, it’s essential to carefully evaluate the costs associated with refinancing to ensure it makes financial sense for your situation. Consulting with a mortgage professional can help you navigate through the refinancing process and determine the best approach to lower your mortgage payment.

Down payment assistance programs

Down payment assistance programs can be a valuable resource for homebuyers looking to reduce their mortgage payments. These programs offer financial assistance to qualified individuals or families to help cover the upfront costs of buying a home. By utilizing down payment assistance, you can secure a mortgage with a lower down payment, resulting in a lower monthly payment. It’s crucial to research and explore the various down payment assistance programs available in your area to find the one that aligns with your financial needs and eligibility criteria.

It’s important to note that while these strategies can help lower your mortgage payment, they may not be suitable for everyone. Each individual’s financial circumstances and goals vary, and it’s essential to consult with a mortgage professional to determine the best course of action. By carefully considering your options and seeking expert advice, you can find strategies tailored to your needs that will lead to more manageable mortgage payments in the future.