Mortgage rates are set by lenders and are subject to changes depending on market conditions. In recent years, the Federal funds rate has fallen to an all-time low, as the coronavirus scare pushed the ten-year Treasury note to an all-time low. This lowered mortgage interest rates, creating money-saving opportunities for homeowners. Learn about the factors that influence mortgage rates and how they differ by lender and type of loan.

Discount points lower interest rates for mortgages

If you plan to reduce the interest rate on your mortgage by paying a certain amount of points, you can do so by taking out a mortgage loan. These points reduce the interest rate by a certain percentage point, but the number of points you can buy varies. Paying a single point may not lower the rate by 50%, while paying two or three points may reduce it by 75 percent. Also, some mortgage lenders offer discounts for prepaid interest, so buying points may have tax benefits for you.

Buying points for your mortgage loan may not make sense for everyone, and it might be too costly for most people. It makes more sense to save more money and pay a higher down payment to ensure you have a lower loan-to-value ratio. However, paying points for your mortgage might be a waste of money if you plan to stay in your home for a long time. As a result, it is important to do your homework and make sure you’re comfortable paying for points.

Lenders have the right to price mortgage financing

While the right to negotiate is a fundamental part of getting a loan, lenders may choose to offer different prices to different borrowers. To avoid being treated unfairly, it’s best to ask for better terms than those that you were initially quoted. Ask if fees can be waived or reduced, or ask if the interest rate can be lowered. Make sure to negotiate fees upfront, such as the discount point. The discount point is equal to 1% of the loan amount.

Federal funds rate affects interest rates for mortgages

One of the major questions about interest rates is how the Fed’s policy moves affect mortgage rates. Although rates tend to move in lockstep with the Fed funds rate, mortgage rates do not always follow suit. Rates move up and down daily in response to changes in the global and U.S. economies. Some days, mortgage rates even move in opposite directions. This is because the Federal Reserve reacts to the same economic developments as the rest of the world.

Although the Federal Reserve does not directly set mortgage rates, its decisions are closely watched by key players in the mortgage industry. Mortgage rates are often affected by the Fed’s interpretation of what the central bank does. Recently, the Federal Reserve announced an increase of half a point in the federal funds rate, and more adjustments are expected before the year’s end. This increase has helped drive down mortgage rates and made them more attractive for home buyers.

First-time homebuyers pay higher interest rates for mortgages

First-time homebuyers typically pay higher interest rates for mortgages than repeat homebuyers, but there are a few ways to lower this. Mortgage rates are rising at a slow pace, and most first-time homebuyers should adjust their target price ranges accordingly. While you may get pre-qualified with the bank you already work with or get a quote from the first lender you see, shopping around is the best way to ensure you’re getting the best deal. You may be tempted to go with the first lender that you find, or you may think that the rates are uniform all across the board. However, mortgage rates differ by as much as 0.5% from company to company.

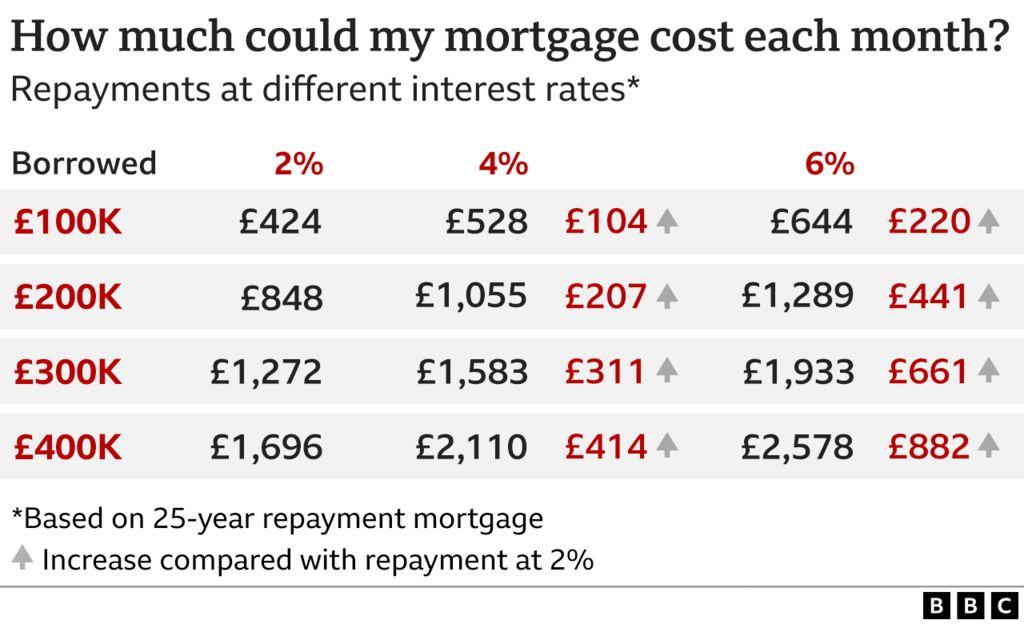

Rising rates are hurting some potential homebuyers, but they’re helping the rest of them. In mid-March, the average mortgage payment was up nearly 25% from the same time last year. That means a typical homebuyer now pays an all-time high of $2,123 per month. Experts believe that rates will gradually rise later this year, easing the supply crunch and allowing the market to rebuild.