When looking for the best mortgage rates for a 30-year fixed mortgage, you should first know how much you can afford to pay. You should also consider the payment terms, interest rate percentage, property taxes and homeowners insurance premiums. If these are not included in the mortgage, you should compare different options before committing to a deal. A 30-year fixed mortgage rate of 5.99% is the lowest rate you can find right now.

Interest rate percentage

One way to get a low 30-year fixed mortgage rate is to refinance your home. Refinancing a 30-year fixed mortgage can reduce your minimum monthly payment and give you greater flexibility. Although you may end up paying a higher interest rate, you will save money every month. This method is best suited for homeowners with good credit. If your credit score is 670 or higher, you can apply for a loan with a low interest rate.

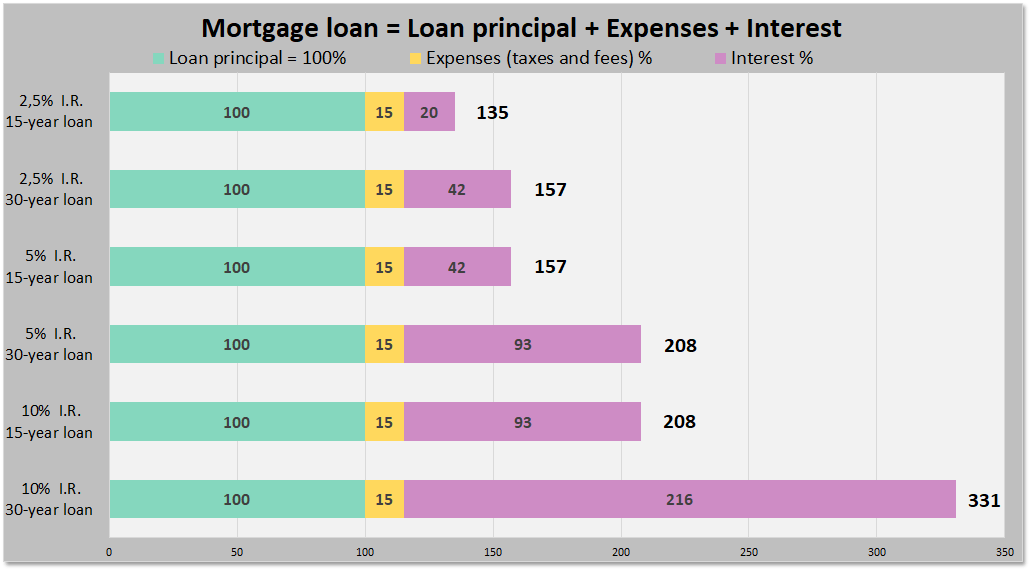

A 30-year fixed mortgage is the most popular type of loan. These mortgages are generally higher in interest than shorter-term loans, but their longer-term allows borrowers to pay more over time. While a 30-year mortgage may have higher interest rates than a 15-year mortgage, the payments are lower and you will not need to worry about adjusting them during the life of the loan. A 30-year mortgage can also help you save for a child’s college education or other major purchases.

Monthly payment

A 30-year fixed mortgage includes interest and principal payments. It also includes payments for homeowners insurance and property taxes. You are required to pay private mortgage insurance if you don’t put 20% of your home’s value down. The longer the loan term, the higher the interest rates and monthly payments will be. If you plan to stay in the same home for 30 years or more, it may be beneficial to look at adjustable-rate mortgages instead of fixed-rate loans.

The monthly payment for a 30-year fixed-rate mortgage is one of the lowest available. It allows you to budget your finances for the entire period. This kind of mortgage allows you to pay more or less than you need to, as you see fit. The predictable monthly payment allows you to plan your budget and avoid sudden shocks when bills are due. It is also an excellent choice if you want to remain in the home for the long haul.

Property tax

In some parts of the country, property tax rates are higher than in other places. In New York, for example, the rate for a 30-year fixed mortgage in Kings County is 1.98%. In contrast, the rates for suburban areas like Westchester and Rockland counties are 1.89% and 2.30%, respectively. While some suburbs have lower property taxes, many smaller ones do not. The difference between property tax rates in smaller cities and those in the Big Apple may be more significant than you think.

Homeowners insurance premiums

If you’re considering getting a home insurance policy, you might be wondering if there are ways to lower the cost. For starters, you can make home renovations to increase your property’s value and reduce its risk of damage. In addition, you can raise your deductible, which will reduce your premiums. Some insurance companies allow you to choose a $500 deductible, which can significantly lower your premiums.

The cost of homeowners insurance is highly dependent on the age and location of your home. A home that was built a few decades ago will cost more to insure, while a newer home made of sturdy materials will cost less. The costs of homeowners insurance cover liability, damage to the structure of the house, and personal property. You should take advantage of this coverage to avoid paying for repairs that you may never need.