You may have been wondering how mortgage rates for a 30 year fixed rate mortgage are determined. The interest rate on a 30-year fixed rate mortgage has increased slightly over the first half of 2021. The amount of the down payment and the credit profile are the two factors that go into determining the mortgage rate. Let’s look at some examples to see how these factors affect mortgage payments. Let’s say a family of four borrows $250,000 for a home. They put down 20%. In this case, the family would pay $926 a month. The same payment would be $926 for a 30-year fixed rate mortgage, but a 15-year loan would cost $1,435 a month. That difference alone would allow the family to spend $6,000 a year on groceries or school expenses. Moreover, if the family isn’t concerned with paying off

Interest rates on 30-year fixed-rate mortgages have risen slightly in the first half of 2021

Mortgage rates have been dipping since the first half of May. This week, the 30-year fixed-rate average climbed to 5.23%. This rate is 2.36 percentage points higher than a year ago. However, the 30-year fixed-rate mortgage remains remarkably affordable despite this trend. The 30-year fixed-rate mortgage is still one of the best deals available for strong credit borrowers.

The rise in interest rates is not entirely unexpected. After two years of declines, rates have remained relatively low for many homebuyers, but higher mortgage rates are still a big drag on the housing market. However, if the U.S. economy continues to recover, mortgage rates should remain at or near five percent. Unlike a decade ago, rates are still attractive compared to the pre-financial crisis levels.

They are higher than those on 15-year fixed-rate mortgages

A 15-year mortgage may be more convenient than a 30-year mortgage, but it comes at a price: higher monthly payments. This reduces the amount of flexibility homeowners have when it comes to making expenses, like paying off the mortgage, or taking care of any other debt. Furthermore, 15-year mortgage payments are not exclusive of the cost of homeownership, such as property taxes, insurance, association fees, or regular maintenance and repairs.

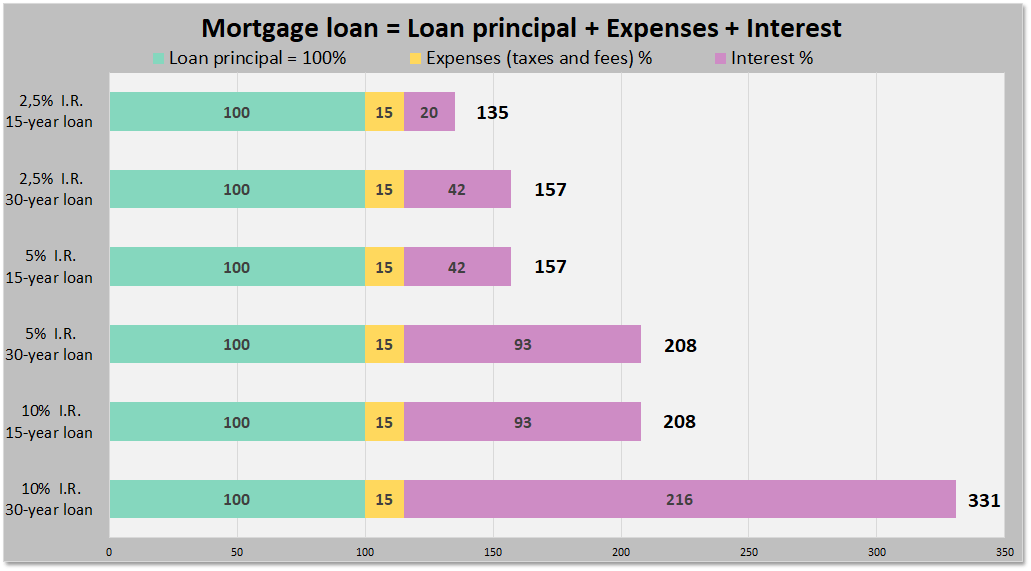

The advantage of a 15-year mortgage is that it takes half the time to pay off a 30-year mortgage, which is beneficial to borrowers. A 15-year mortgage will also pay off your loan in half the time, which means that you will pay less interest in the long run. Because the payments on a 15-year mortgage are higher than those on a 30-year mortgage, it may be the best option for some borrowers, but keep in mind that you are paying twice as much in interest over a shorter period of time.

They are determined by credit profile

The interest rate on a standard 30-year fixed-rate mortgage is calculated using the 10-year U.S. Treasury rate, plus a spread that represents the risk of default to the investor. The spread rises or falls with changes in general economic conditions and the prevailing interest rate environment. Mortgage rates tend to rise or fall with changes in the risk to investors, including market demand and supply forces.

As the mortgage rates are based on a person’s credit score, a high FICO score will result in a lower mortgage rate than a low one. A 760-850 credit score, for example, will mean a lower interest rate of 3.75% than a 660-679 credit score. Although higher mortgage rates are not a good deal, they can help a person save money every month and make qualifying for a mortgage easier.

Down payment

If you plan to pay off your loan early, a 30 year fixed-rate mortgage is one of the best options. Most lenders allow you to pay off the mortgage at any time during the term of the loan without penalty. However, some lenders have strict rules when it comes to early payoff. If you are planning to pay off the mortgage early, you should check with the lender to see if there is a prepayment penalty.

Another consideration is the length of the loan. A 30-year mortgage will cost about $120,000 more than a 15-year one. While 30 years are longer than 15-years, the loan will be easier to pay off. If you do not plan to keep the house for that long, it might be beneficial to pay extra for a smaller down payment. You can sell the house before the term is up if you’re not happy with the payment amount.

Debt load

If you are planning to stay in your home for the next thirty years, a 30-year fixed-rate mortgage may be the right choice for you. A fixed-rate mortgage will give you a predictable interest rate and a shorter payback period, allowing you to manage your finances more effectively. Moreover, it offers the flexibility to make additional payments to the principal, which will reduce your overall debt load and allow you to pay off your loan earlier.

A 30-year fixed-rate mortgage is a more costly loan than a fifteen-year fixed-rate mortgage, and will require more interest over the entire loan term. To calculate the difference, look at the amortization schedule for each loan. If you have the resources, look into government loans and other options. They may be more affordable than other mortgage types for those who qualify. Debt load for a 30 year fixed-rate mortgage may be a good choice for you if you can afford it, but make sure you know what the monthly payment will be before you sign the contract.