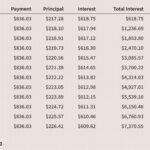

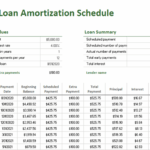

To calculate the amortization of a mortgage loan, enter the interest rate and loan amount to generate an amortization schedule. Once you’ve generated the schedule, click on the “Monthly Payments” tab to view the balance of each monthly payment. This will show you how your payments will be split over the life of the loan. Each month, you’ll make smaller payments on the principal, and as the principal balance decreases, so does the interest.

Calculate loan amortization

Using a calculator to calculate loan amortization for a mortgage is particularly useful for people who don’t understand how loans work. Mortgages typically have a 15 to 30-year loan term, and the math behind calculating the payments can be complex. However, a calculator can estimate the payments for other types of loans. With the right information, a borrower can make the best decisions for their situation.

A mortgage amortization calculator calculates monthly payments over the life of a mortgage. It displays the remaining balance and total interest paid, as well as the dates when the payments will end. The amortization table will also show the principal and interest owed at various points during the loan term. A mortgage amortization calculator will also show when payments will be extrapolated to reduce the outstanding loan balance. This makes it easier to understand the relationship between payments and the total balance of the loan.

Enter loan amount

You can use an amortization calculator to work out the cost of your home payment over time. You’ll need to know how much principle you borrowed and the interest rate in whole numbers. The interest rate is the cost the lender charges you to borrow the money. Longer loan terms tend to be more expensive because the lender is likely to collect higher interest on those loans. The Consumer Financial Protection Bureau offers a tool for checking current interest rates.

A mortgage amortization calculator will break down your payments into monthly payments that are both interest and principal. You can use these calculators to figure out your interest over time and how much money you’ll owe in total. Some financial amortization calculators will also give you insights into how extra payments or a larger down payment will affect the amount you pay each month. Other tools will show you what your principal balance will be at the end of the year, and how much equity you’ll have built up.

Enter interest rate

Using an amortization schedule calculator is a simple way to estimate your mortgage payments over time. Enter the interest rate, principal balance and loan term. You can also enter additional payments to determine the total interest that you will pay over the loan. In most cases, you can choose a 30-year mortgage term or a 15-year loan. In some cases, the amortization schedule calculator will allow you to enter the rate of interest you will pay during different periods of time.

An amortization calculator calculates the monthly payment. It also calculates the remaining balance, total principal, and total interest. The loan amount is the amount you owe to the lender. The interest rate is the percentage of the loan amount that the lender charges. The term of the loan is the amount of time it will take to pay off the mortgage. In some cases, you can change the loan term to reduce the amount you pay each month.

Create amortization schedule

There are several ways to create an amortization schedule for a mortgage. The loan amount is called the principal and the interest will be paid throughout the life of the loan. The amortization schedule should show both the interest costs and the principal payments. Creating an amortization schedule is easier than estimating the monthly payments based on an estimate. You can easily create one yourself using a spreadsheet program such as Excel. You can even create one for a particular loan type using the AutoFill feature in Excel.

Once you know how much you can afford to pay each month, you can create an amortization schedule. By examining a sample amortization schedule, you can determine the length of the loan. A 30-year loan will give you a lower monthly payment but more interest over time. Additionally, remember to include monthly expenses such as mortgage insurance and property taxes. Make sure to estimate the amount of extra payments you can make to lower your monthly payments before calculating the total cost of the loan.