An amortization calculator for a mortgage is a useful tool for determining how much you will end up paying over the life of a mortgage loan. These mortgage calculators will show you how your payments will be divided between the principal and interest over time. The principal of your mortgage loan is the amount you borrowed, and as you make monthly payments, it decreases over time. In addition, an amortization calculator can help you calculate your monthly payments.

Using an amortization calculator for a mortgage

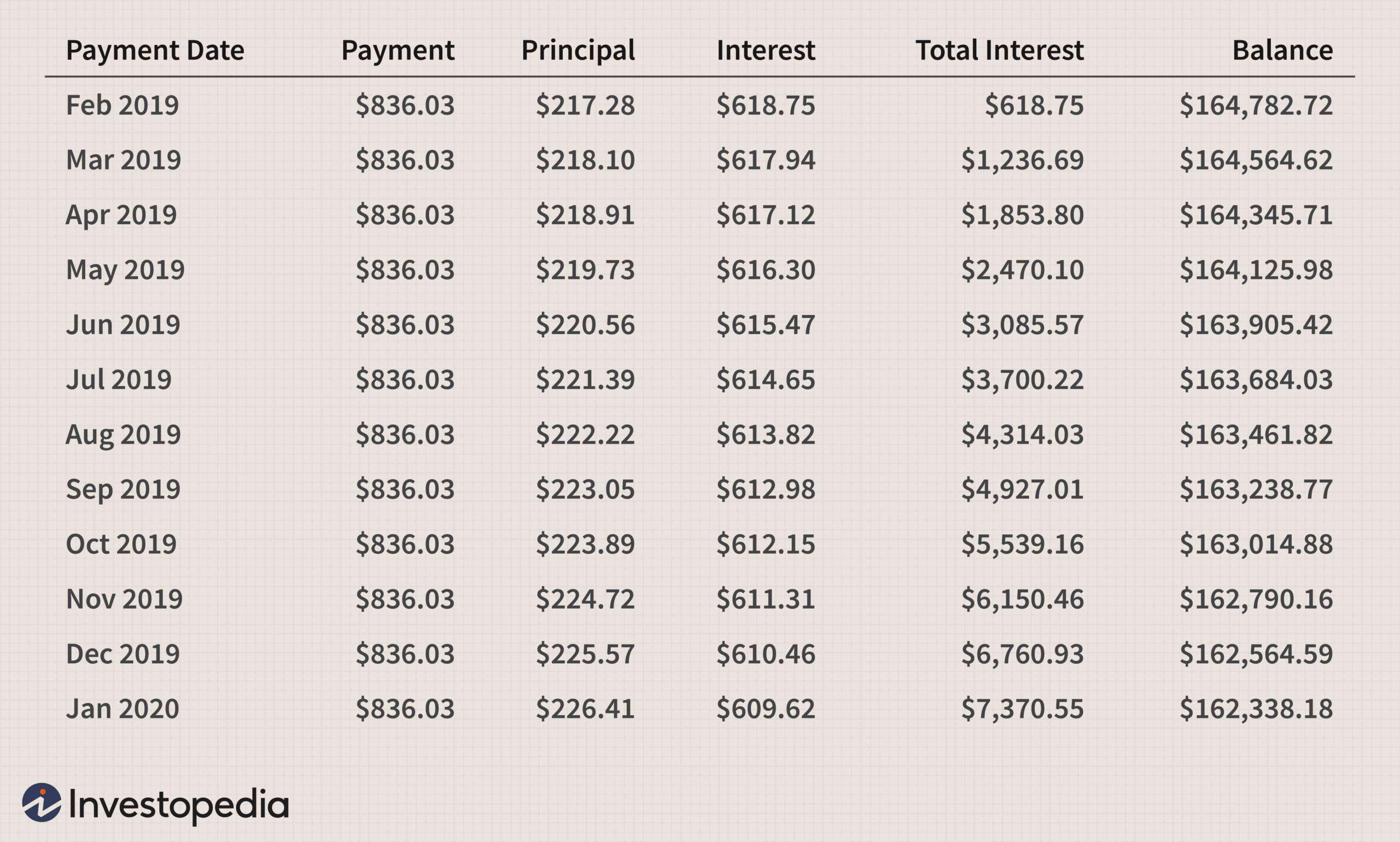

A mortgage amortization calculator shows you how much you can expect to pay over the life of the loan. The amortization schedule shows the interest and principal balance owed and how much each payment will reduce the total balance. You can enter extra payments as well, and the calculator will calculate how long your mortgage will last. If you plan to pay off the loan early, you can use an amortization calculator to plan the payments for the rest of the loan.

When calculating your monthly payments, you should take into account the length of the loan and the interest rate. Usually, the longer the loan term, the longer it will take to pay off the principal. This means that the early years of the payments will be spent paying interest and the rest of the money will go toward the principle. An amortization calculator will tell you the payment structure for the loan so that you can calculate the payment amount based on the interest rate, length of loan, and other factors.

After entering all of the relevant information, you will be presented with a table displaying the amount of principal you owe at a specific date. You can also input additional payments if you need to. A mortgage amortization table will also show the total amount of interest you will pay over the course of the loan, and the equity you will have in your home at the end. In addition to providing an amortization schedule, a mortgage amortization calculator is very useful for planning and comparing different scenarios.

Creating an amortization schedule

Creating an amortization schedule for a loan is a great way to save money and plan for your financial future. This article will explain the importance of an amortization schedule, the major advantages of using one, and provide tips for creating your own. You may also want to read a related blog article about tips for paying off a loan early. Read on to learn more about this vital tool. You will also discover some easy methods to use an amortization schedule.

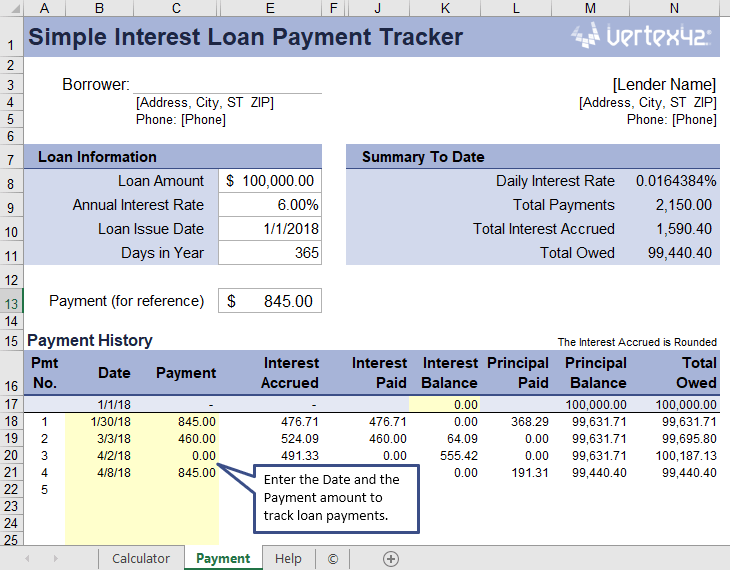

First, you need to figure out how to calculate the principal portion of your payment. Subtract this amount from the beginning balance of the period you are calculating. The formula should be something like =$B8-$D8. Then, in cell B9, include the relative reference to the end of the previous period. Finally, in cell H9, create a formula for tabulating the amount of interest and principal you’ve already paid.

By using an amortization schedule, you can see exactly how much each payment will cost over time. A standard amortization schedule does not account for extra payments that you may make toward the principal, but they may reduce your remaining loan payments. Using a mortgage amortization calculator can show you how different interest rates and terms affect your total cost of the loan. By putting extra payments toward the principal, you can save money and pay off the loan sooner. The amortization schedule you create will depend on the type of loan you take out and the interest rate you’ll pay.

Entering your interest rate

The amortization calculator can give you a rough idea of what your monthly payment will be. Unlike a traditional mortgage, however, it is based solely on the interest rate that you input into the mortgage calculator. There are some other variables to consider when deciding on an interest rate, including loan fees and closing costs. Variable rates are also a factor to consider when determining your monthly payment.

If you’re planning to take out an adjustable-rate mortgage, you may need to enter the variable rate to get an accurate calculation. An interest rate calculator is not the best tool to determine this figure, as it does not take into account variable rates. But if you’re interested in knowing how long it will take you to pay off your loan, an amortization calculator can help. By entering your interest rate in an amortization calculator, you can get an idea of how long it will take to pay off your loan.

An amortization schedule calculator breaks down the amount of principal and interest owed each month into an easy-to-understand payment schedule. The amortization schedule will show you the total principal paid over the term of your loan, including interest, and the monthly payments. The calculator will also let you know how much you’ll owe at the end of the year and whether or not you’ll have any equity to build.