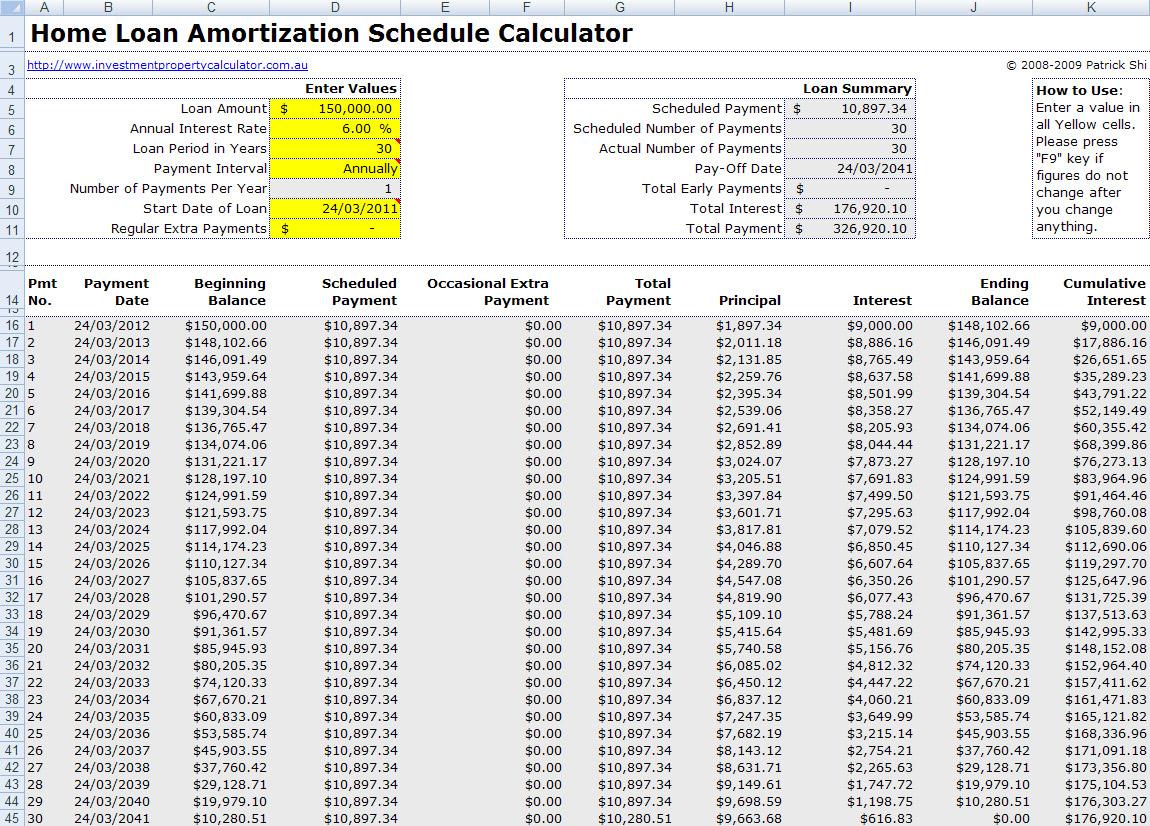

Using an amortization calculator for a mortgage will help you determine how much you need to pay each month to make your monthly payments. Enter your interest rate, loan amount, and term. You can use the calculator as often as you like. You can also mix and match interest rates. The key to making good decisions with an amortization mortgage is understanding how much you owe each month. Using an amortization calculator is an easy way to see how much you owe, and how much you’ll pay over time.

Calculate your monthly mortgage payment

An amortization calculator will calculate your total mortgage payment for you, taking into account the mortgage interest rate, real estate taxes, and homeowners insurance. It will also take into account the length of the loan, interest rate, and term. The term “mortgage” comes from the Latin word “Mortis,” which means death. The loan is repaid until the home is paid off, which can be many years or even a lifetime.

A mortgage payment is made every month, with a portion of it going toward interest and the rest towards the loan balance. The monthly payment may vary depending on the type of loan you have, but it will always include taxes and insurance. For instance, if you do not put down 20%, you will have to pay PMI. A lower interest rate means a lower monthly payment, so make sure you shop around for a mortgage with as much of a down payment as you can afford.

Enter your interest rate

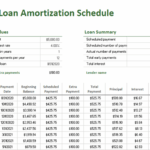

An amortization calculator for a mortgage requires that you input the interest rate you are considering. You can also enter the range of interest rates that are available for mortgages in your area. A good tool to use is the Consumer Financial Protection Bureau’s interest rates explorer. The calculator will take into account these different factors, so you can find the right payment for your specific situation. The amortization schedule tab allows you to see how your monthly payments will break down into principal and interest.

An amortization calculator shows you how long your loan will take and the total interest you will pay over the life of the loan. It also gives you an idea of how much extra payment you can make or increase your monthly payments to reduce the length of your loan. By reducing your total interest amount, you will save thousands of dollars in interest and build equity faster. An amortization calculator also allows you to see how many extra payments you can make and how much you can afford.

Enter your loan amount

A mortgage amortization calculator is a useful tool to estimate your monthly and yearly payments. It lets you choose an interest rate that suits your budget, and you can enter your loan amount to see how much you will owe over a specified period of time. A mortgage amortization calculator will also allow you to enter the term of the loan, which is important because shorter terms require longer payments than long ones.

Once you have entered your loan amount, the amortization calculator will calculate your monthly payment based on your interest rate and the length of the mortgage. It will also calculate the total amount of interest and principal that you will pay over the course of the loan. The loan amount is the amount you owe the lender minus any interest. The interest rate will depend on the interest rate, but it will be calculated as a percentage of the total loan amount. The loan term refers to the length of time you will pay off the mortgage.

Enter your loan term

The length of your loan affects the monthly payment amount and total interest paid over the life of the loan. A longer loan is likely to have a higher interest rate, as lenders typically charge more to lend you money. The Consumer Financial Protection Bureau offers an interest rate explorer that shows you how different interest rates compare with each other. Use the calculator to determine your payments over the life of the loan, and find out how much you’ll have to pay over the long term.

The amortization calculator will break down the amount of principal and interest into monthly payments. This will tell you how much total interest will accrue over the life of the loan. In some cases, financial amortization calculators also provide useful insight into the effect of extra payments or a larger down payment. They can also tell you how much you will have left in your principal at the end of the year, and even show you your equity build rate.

Enter your property value

To find out how much you will be paying each month in mortgage payments, you must enter your property value into an amortization calculator for a mortgage. There are various types of calculators, and the most common one is a simple interest-only one. You can also use an amortization calculator to figure out what you will pay in monthly installments each year. In addition to calculating the monthly mortgage payment, the amortization calculator will also factor in the cost of homeowners insurance and taxes.

Another type of mortgage calculator allows you to calculate how much you can afford to pay each month. Enter your property’s value and down payment amount into the calculator. You will see how much you will pay each month, as well as your annual payment. As you make monthly payments, the principal balance decreases, and the total interest due is reduced. In addition to the interest payments, this calculator also considers the extra monthly expenses, such as homeowners insurance and property taxes.