While interest rates are an important factor in deciding which mortgage is best for you, they do not tell the whole story. Besides interest rates, there are fees, points, and other costs you should compare when comparing mortgages. A current rate quote is essential for getting a reliable estimate of your monthly payment. This will give you a clear picture of your borrowing power and the total cost of owning a home. Read on to discover more about interest rates and how they affect your mortgage payments.

Interest rates for 30-year fixed-rate mortgages

The current state of the housing market and the Federal Reserve’s war against inflation will play a big part in the decision to increase interest rates for 30-year fixed-rate mortgages. Historically, these rates were close to 3%, but with the recent COVID-19 pandemic, they’ve fallen to just below three percent. Despite this, interest rates for 30-year fixed-rate mortgages are expected to continue to increase in the coming years.

The average 30-year fixed-rate mortgage increased 5 basis points this week to 5.721%. Similarly, the average 15-year fixed-rate mortgage was up 14 basis points to 4.827%. Adjustable-rate mortgages are considered riskier because they can adjust from a lower to a higher rate over time. But if you’re on a tight budget, adjustable-rate mortgages are an excellent option.

Interest rates for refinances

There are different reasons that homeowners opt for refinancing their home loans. It could be for consolidating debts, tapping equity in the home, or to lower their interest rates. While refinancing a home loan may worsen a debt problem, it is an excellent option if you want to save money. While historically, refinances are recommended if the interest rates are reduced by at least 2%, many lenders say a 1% savings is enough to make it worthwhile. To make a good decision, use a mortgage calculator to help budget the costs.

When refinancing your home loan, make sure your credit is in good shape and you have adequate savings. Gather all your financial documents, including the loan amount and current home equity. Your credit score will have a significant impact on your interest rate, so it is important to maintain a healthy score. Nevertheless, the good news is that the rates are still reasonable for most borrowers. By improving your credit score, you can take advantage of the current low interest rates for refinancing your home loan.

Inflation

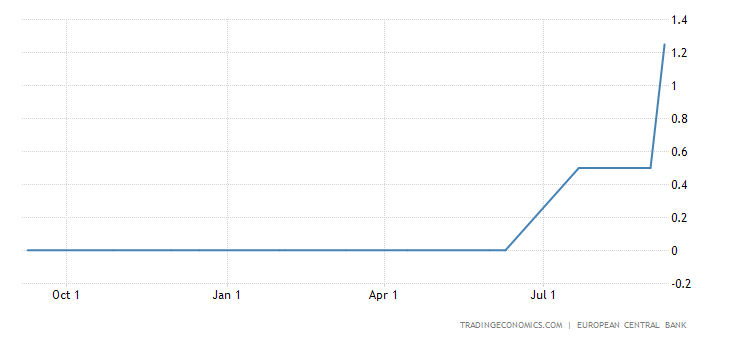

Inflation in mortgage rates is a concern for many homeowners, but the current low interest rates are a good thing for borrowers. In March, the Federal Reserve raised the federal funds rate, an overnight lending rate used by banks to meet reserve requirements. The Fed raises interest rates to combat inflation, but this decision does not directly affect mortgage rates. Nevertheless, it does influence mortgage lenders, who move their rates accordingly. Until inflation falls, mortgage rates are likely to continue to increase, but there is no certainty that they will stay at this level.

The Fed’s massive increase in money supply will eventually slow the U.S. economy. The Fed’s massive increase in money supply, which is currently being used for COVID relief spending, is likely to result in high inflation in the U.S. in the next several years. At that point, inflation will return to the range of 2.5% to 3%. Once this happens, the “real” mortgage rate will be positive again.

Geopolitical events

While geopolitical events affect mortgage rates to varying degrees, recent declines in rates are entirely predictable. Ten-year treasury yields are an important indicator of mortgage rates and may be influenced by geopolitical tensions. However, geopolitical events also affect rates for other reasons. For example, sanctions on Russia could cause gas prices to increase, making mortgage rates more expensive. However, the short-term impact of geopolitical events is relatively small.

Historically, periods of elevated geopolitical risks have weighed on global economic activity. Wars, for example, can disrupt the food supply chain and disrupt credit production. Inflation and increased uncertainty may also impact interest rates. However, the recent Russia-Ukraine conflict has made this question more relevant than ever. The latest global geopolitical risk is Ukraine. A conflict in Ukraine could negatively impact global economic activity.

Unemployment levels

In order to determine whether a particular interest rate is low enough to warrant an increase, it is necessary to consider the United States’ unemployment levels. The US Bureau of Labor Statistics releases the “Employment Situation” report every month, excluding farm workers, government workers, and certain other employees. This report generally shows that the unemployment rate has decreased over the past year, dropping from 5.8% to 5.4% in July. Mortgage rates tend to rise and fall in response to these reports.

In addition to unemployment, the Bureau of Labor Statistics also releases the Employment Situation Summary, or Jobs Report, which gives a more detailed report on the state of employment in the country. It also gives a clearer idea of how many people are working, and how much they earn. The official unemployment rate is included in the Employment Situation Summary, which carries greater weight than the more general unemployment rate. It is also considered to be a stronger economic indicator than other reports.