Many people want to know how much they should pay each month for their mortgage, but how do you figure out if you can afford to pay that amount? There are several different types of mortgage calculators, and some even have “Extra payments” functionality, which allows you to input additional payments each month, yearly, or one time. These extra payments will then be applied to a new payoff date, and are added to the principal amount as well.

Down payment

You can use a down payment calculator to estimate how much money you can afford to put down when purchasing a home. Most people focus only on the down payment, but they forget to include all of the associated costs, such as homeowners association dues, property taxes, and insurance. A mortgage calculator will make this process as simple as possible. To get started, select the type of mortgage and the down payment you can afford. You’ll then see a breakdown of the payment amounts for different mortgage types.

There are many advantages to using a down payment calculator. It provides customized information and makes assumptions about the costs of mortgage insurance and other expenses that you should plan for. It will help you determine how much money you need to save, which you’ll need for closing costs and mortgage insurance. It will also tell you what your monthly payments will be, so you can plan ahead for the down payment. Using a down payment calculator is also helpful in determining the amount of cash you have saved for the down payment.

Interest rate

When calculating the monthly payment on a mortgage, it is important to understand the difference between a variable and fixed interest rate. Variable rates vary based on a variety of factors, such as inflation and market indexes. While fixed rates remain the same throughout the life of the loan, they can be higher than fixed rates. An Interest Rate Calculator can help you figure out which loan will be the most affordable for your budget and lifestyle.

When using an interest rate for payment calculator, you can input the current interest rate to find out how much you can afford to pay each month. You can enter an interest rate range if you are shopping for a mortgage at the moment, or simply use the average mortgage rate. This can be a handy tool when considering the affordability of a shorter loan term. Once you have calculated your monthly payments, you can enter other important information, such as property taxes and homeowners insurance.

Homeowner’s insurance

A homeowners insurance payment calculator helps you to estimate the cost of a policy by taking into account variables. For example, it helps you determine how much the insurance will cost you on average per year. The calculator takes these variables into consideration and uses simple assumptions to estimate the cost of your coverage. By comparing the different coverage types available, you can find the right type of homeowner’s insurance for your needs. Here are some of the steps to calculate the costs:

The cost of insurance is directly related to the risk of damage to a home. In general, the greater the risk, the higher the premium. Florida and Texas are among the most expensive states for home insurance. Conversely, New York and California have lower risk of damaging wind events and thus lower premiums. To estimate the cost of homeowner’s insurance, you can divide the value of your home by $1,000 and multiply by $3.50. A home worth $400,000 would have a monthly premium of $1400.

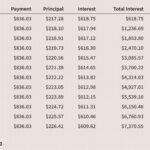

Amortization schedules

Amortization schedules for a loan are a crucial part of the mortgage process, and they give borrowers a better understanding of how much they’ll have to pay over the life of the loan. They also show how much interest and principal a borrower will have to pay. Using an amortization schedule calculator can be a valuable tool in this process. You can enter your mortgage terms and monthly payments to create an amortization schedule. You can also create a custom amortization schedule by hand in Microsoft Excel or a similar program.

Amortization schedules for a loan show the amount of principal and interest that will be paid each month. It also shows how each payment will be applied to the principal and interest. An amortization schedule is especially useful for tax deductions. Amortization calculators can generate these amortization schedules for you. However, they should be used only for loans that are longer than five years. This will save you a lot of money and stress in the long run.

Homeowner’s association fees

There are many factors to consider when choosing a home, and homeowner’s association fees are no exception. While monthly fees are a necessary part of housing, they can also add up to a significant portion of the total housing expense. Lenders take these fees into consideration when analyzing a loan’s figures. The monthly HOA fee is calculated by taking the total debt and dividing it by the gross monthly income.

HOA fees vary depending on the location and type of unit. A condo, for example, is usually less expensive than a coop. However, you’ll need to pay taxes separately, and a large unit will have higher HOA fees than a small one. Other factors to consider when determining your HOA fee include the number of units in the building, the amount of amenities, and the location of the building. Monthly HOA fees can run anywhere from a few hundred dollars to nearly $1500.