There are many benefits to using a mortgage calculator. You can enter a range of different interest rates in order to get a better idea of how much you can afford to pay in total. You can even use a loan start date calculator. Once you’ve used the calculator to calculate your mortgage loan payments, you can then use the results to shop for the best loan. And when you’re done, you can easily compare your results to the average mortgage rate in your area.

Using a mortgage calculator

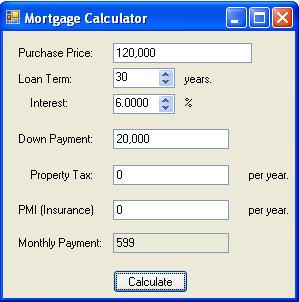

Using a mortgage calculator is an excellent tool to find out what your monthly mortgage payment will be. This tool allows you to play with scenarios, such as the maximum interest rate and the length of repayment. It is also a helpful tool for negotiating your mortgage terms. You can change the variables to suit your specific situation. Whether you qualify for a mortgage depends on your income and debt-to-income ratio, which can be determined with the help of a mortgage calculator.

One of the first steps to calculating your monthly payments is to input your current debt-to-income ratio. This is essential because the interest rate you will get will depend on several factors, including your credit score and your debt-to-income ratio. The down payment you choose will also affect your mortgage payment, so figuring out your payment before you start applying for a mortgage will help you plan accordingly. However, keep in mind that the interest rate you’ll receive is an estimate and may vary from the actual one.

Using a mortgage calculator is an essential step in purchasing a home. Whether you’re buying a home for the first time or re-financing an existing property, knowing how much you can afford to pay for a mortgage is vital. Using a mortgage calculator can help you determine your budget, as well as calculate the total amount of interest you’ll be paying over the loan life. You’ll also need to take into account the mortgage insurance and homeowner’s insurance.

Using a fixed rate mortgage calculator

A fixed rate mortgage calculator can help you figure out how much you’ll pay in monthly installments on your new loan. You can enter the loan amount and term into the calculator to get an estimated monthly payment. A fixed rate mortgage calculator will take into account additional monthly costs such as homeowners insurance and property taxes. The longer the loan term, the lower the monthly payment will be. This type of mortgage calculator is also helpful when you’re trying to determine whether it’s affordable to take on a shorter term.

A fixed rate mortgage calculator will help you figure out the monthly payments that are most affordable for your current financial situation. The tool allows you to enter the loan amount and various inputs, and it will provide a realistic estimate of the mortgage payment and total cost of the loan. Mortgage calculators can also help you compare different loan types. For example, a 30-year fixed-rate mortgage has lower monthly payments, but it will cost you more money in interest over the life of the loan.

The calculator will help you compare a fixed rate mortgage to two types of ARMs: the adjustable rate mortgage. A fixed rate mortgage will always be the same payment amount, whereas an adjustable rate mortgage (ARM) will change over time. An adjustable rate mortgage can increase your payment amount depending on market conditions and your financial circumstances. When comparing ARMs and fixed-rate mortgages, it is important to know which type will save you the most money in the long run.

Using a loan start date calculator

Using a loan start date calculator is useful when you know when your monthly payments will begin and end. For example, if you have a five-year loan, the start date will be October 1, 2017. If you know you’ll pay this loan back in 52 weeks, you’ll know exactly how many payments you’ll make each month until the end of your loan term. However, if you don’t know this date yet, you can enter zero for the unknown value and then update the start date accordingly.

The most common mistake people make when using a loan start date calculator is to choose the wrong dates. This can result in inaccurate payment amounts and interest charges. To make sure you match other calculators, you should set your Loan Date and First Payment Due dates to the same period. In this case, the “Payment Frequency” field should be monthly and the “First Payment Due” field should be June 15th. You can also click on the “Long Period Options” tab to see additional information about payment amounts and interest calculations.