Why Interest Rates For Mortgages Changed and What You Can Do About It

Inflation

Inflation is a phenomenon in which the cost of goods or services increases in proportion to the level of price increases. The United States is no exception, as the Bureau of Labor Statistics reported that inflation rose to 7.5% in January. If the inflation rate continues to increase, the Federal Reserve is likely to raise its short-term interest rate, increasing lenders’ costs and passing that cost on to borrowers. The effect of this is that mortgage interest rates rise in tandem.

Inflation is a reflection of the overall economy and is a key consideration for mortgage lenders. Mortgage interest rates have to be high enough to counteract the effect of inflation and still give a real profit. A 5% mortgage rate will produce a real return of only 3%. Lenders closely monitor the inflation rate to determine how much more they can charge borrowers. For example, if inflation increases to three percent in a year, the real return from a loan with a five percent rate will be 3%.

Geopolitical events

The recent invasion of Ukraine by Russia has put geopolitical risk back on the radar. This war has disrupted the supply chain of food and credit, raising the cost of living and driving up inflation. The ongoing war in Ukraine is expected to continue, resulting in heightened uncertainty and increased interest rates. Moreover, this conflict is a risk factor for global mortgages, as its effects will be felt for some time.

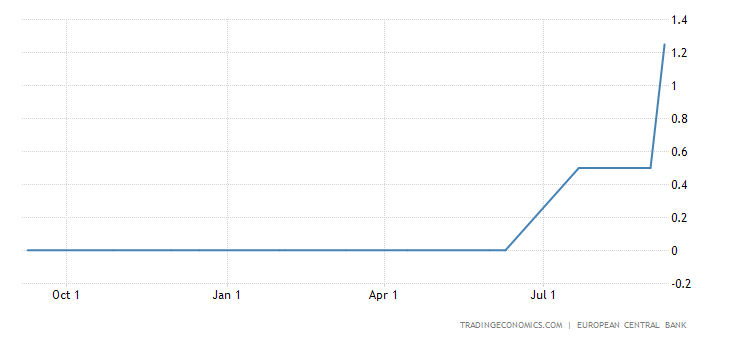

In the past six months, mortgage rates have risen by nearly one percent. But the recent geopolitical events have put a damper on those rates. The conflict in Ukraine is a major concern for many investors, who believe the crisis could stifle global economic growth. However, analysts warn that war can cause a slowdown in the U.S. economy. As a result, war is likely to dampen the economy.

Unemployment levels

What do unemployment levels and interest rates for mortgages have to do with one another? This report reveals how many people are unemployed nationwide. The Labor Department measures unemployment in six different ways. The U-6 rate is the broadest measure. Both a weak jobs report and a high unemployment rate can affect mortgage rates. The following information can help you determine the best time to buy a house and lock in the lowest interest rate possible.

The unemployment rate tracks the number of people working, and historically, it has been a reliable predictor of wage growth. The unemployment rate has continued to increase even after the end of a recession, but it has not rocketed as quickly as during the recent coronavirus crisis. Instead, it rises in small increments. And when it does, it generally lags behind the rest of the economy.

Changes in the cost of credit

Changes in the cost of credit for mortgage loans are closely tied to the overall economy. Rising unemployment rates, for example, have caused interest rates to rise. Those rates have made mortgage loans more affordable for borrowers. Banks receive rate sheets every day. These rate sheets change multiple times throughout the day. While rates may fluctuate, they are usually very favorable when compared to pre-financial crisis levels.

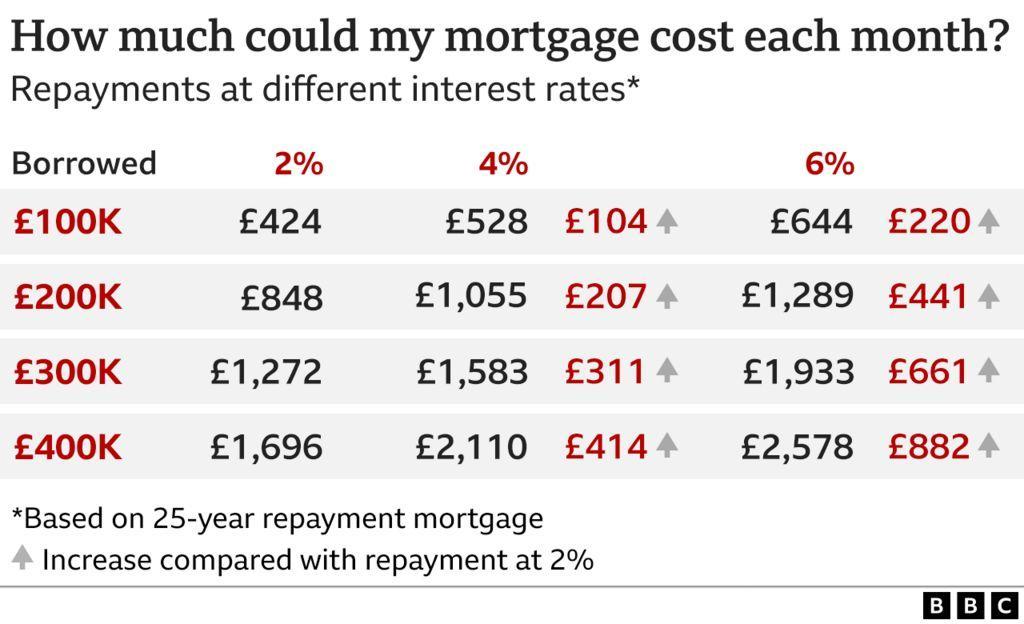

Mortgage rates are not set by the Federal Reserve, though it often affects other loans, including home equity lines of credit and auto loans. The Fed may not raise rates, but a rising economy can dampen the effect of the move. Homebuyers have already felt the impact of rising mortgage rates. Mortgage rates have already jumped two percentage points over the past year, and they have reached five percent in some cases.

Bank of England

The Bank of England is set to decide the interest rates for mortgages this Thursday. With inflation accelerating and the cost of living rising, the Bank has been under fire to curb the pace of rises. It is widely expected that interest rates will increase by 0.25 percentage points to 1.25%, and borrowers with tracker mortgages and short-term deals are guaranteed to pass the increase on. Santander, for example, has been implementing a follow-on rate for borrowers, which is currently 3.25 percentage points above the base rate. The following announcement will see this rate rise to 4.5%.

The bank is also likely to increase rates again in the autumn of this year, and it is expected that the base rate will reach over 2.5% in February and 2.5% by the end of 2023. If you’re planning to purchase a property in the UK soon, it’s best to lock in a low interest rate now while you can. If you think interest rates will go up, it’s worth locking in a fixed rate deal for two or five years.

Federal funds rate

The Federal funds rate for mortgages (FFR) is the short-term interest rate set by the Federal Reserve. The average 30-year FRM is a little more than 5 percent. This level is historically low. While the FRM can change on a daily basis, it tends to rise more slowly than other rates. Lenders set their rates using a variety of factors, including the current federal funds rate, competition, and staffing available to underwrite loans. Generally, mortgage rates rise about 1.8 percentage points higher than the 10-year Treasury note.

This increase is not the only effect of the Fed’s decision to raise rates. It affects mortgage rates indirectly as well. Adjustable-rate home equity lines of credit (HELOCs) will rise 0.5% in the next billing cycle. Mortgage rates may rise in response to the Fed’s action, but they won’t go down any time soon. The Fed is widely expected to raise the federal funds rate several times during the next decade.