Are Today’s Interest Rates For Mortgages Still Attractive?

Are today’s interest rates on mortgages still attractive? The Freddie Mac survey differs from Bankrate’s by showing the interest rates over the past two decades. Though rates are now higher than a decade ago, they are still attractive compared to pre-financial crisis levels, according to Ace Watanasuparp, national director of strategic sales at Citizens Bank. However, many mortgage lenders are urging consumers to make sure they do not take advantage of these low rates.

Average 30-year fixed mortgage rate

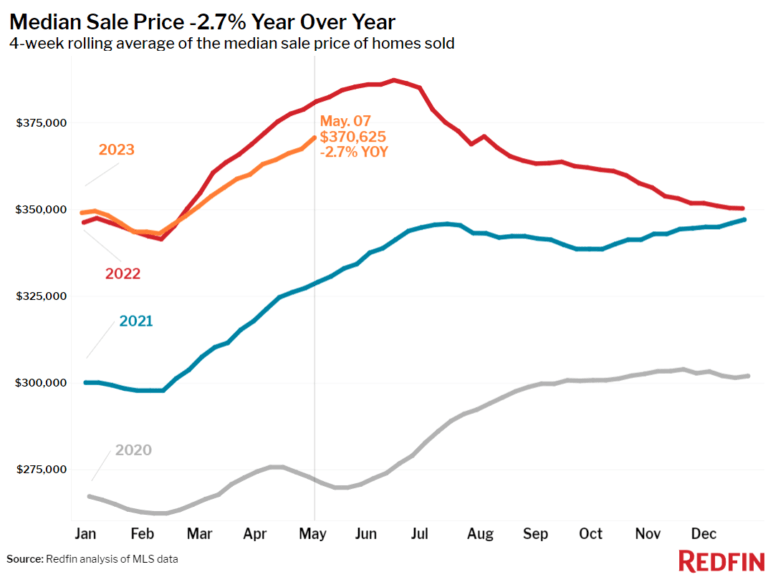

The average 30-year fixed mortgage rate today depends on a number of factors. This rate includes the annual percentage rate (APR) and lender processing fees. It is important to remember that rates change daily, so the current rate you’re quoted may not be the same as what you’ll pay in the end. However, these fees are worth considering if you’re looking for a lower rate. A good mortgage rate is 0.75% to 1% lower than today’s average.

This is based on various assumptions, so the actual rate you’ll be quoted might not match the figure shown. In addition, the average rate is a national average. A 30-year fixed mortgage, for example, is 5.90 percent today. This rate decreased by 11 basis points over the past week. The rate on 15-year fixed mortgages is 4.85% today, while the rate on 5/1 adjustable-rate mortgages is 3.94%.

If you’re looking for a specific rate, you can check Freddie Mac’s website. They have historical data and a daily index. If you need more information, try the FHFA’s monthly survey and Freddie Mac’s survey. If you’re still not sure, you can always check the Mortgage News Daily website for the current 30-year rate. This index is updated frequently, so you can use it to get an idea of what to expect.

Average 15-year fixed mortgage rate

The average 15-year fixed mortgage rate today depends on many factors. The overall interest rate market influences mortgage rates as do supply and demand of mortgage-backed securities. You can reduce the overall interest rate by focusing on factors you can control. Below are some tips to help you find the best rate for your loan. Also, keep in mind that the 15-year rate fluctuates daily. A low home value means lower risk for the lender, and a high down payment lowers the principal balance.

The average 15-year fixed mortgage rate began to trend downward in 2000. In the first half of the 2000s, rates were at an all-time high of 7.725%. By 2003, they were at their lowest level in seven years, a drop largely attributed to the recession in 2001. However, the rates continued to drop until 2008, when the subprime mortgage crisis impacted the economy. The average 15-year fixed mortgage rate today is 2.61%, down from 4.75% in 2007.

A bigger mortgage payment will eat up more of your monthly income. That means your debt-to-income ratio will likely be higher, too. A 15-year mortgage payment combined with any existing debts will take up around 43% to 50% of your monthly income, which is more than you can afford. Therefore, you may want to consider lowering your debts before obtaining a 15-year fixed mortgage. If you are unsure whether a 15-year mortgage is right for you, use a mortgage calculator to compare the cost of a 15-year vs. 30-year mortgage.

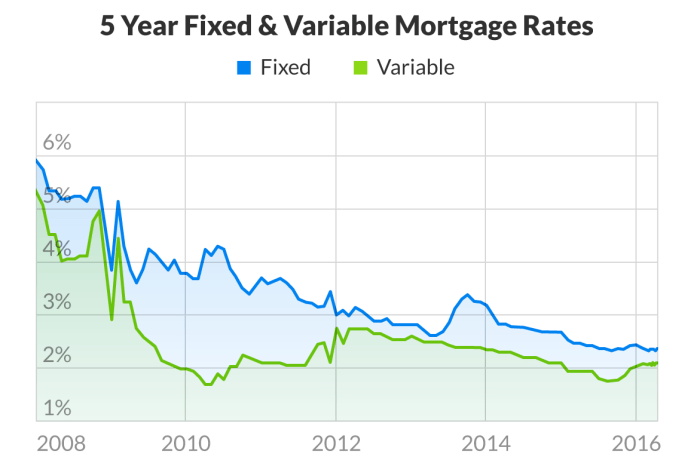

Average 5/1 adjustable-rate mortgage (ARM) rate

An average 5/1 adjustable-rate mortgage (ARM) today is 3.55%, or slightly more than the fixed-rate rate of 4.125%. For a family of five with a 20% down payment, this loan would cost $1,050 a month. These payments include principal, interest, insurance, and property taxes. After the introductory period, however, the payments will increase and are less predictable, depending on the macroeconomic environment.

While the average 5/1 ARM rate today is the lowest of the three, it isn’t always the best choice. For cautious borrowers, it may be wise to limit their exposure to higher interest rates. For that reason, a 5/1 ARM may be a better choice if they are able to match the fixed-rate period to the timeframe that they expect to own the home.

In addition to the introductory fixed-rate period, borrowers can also take advantage of the lower ARM rates in subsequent years. While they might not be able to save a large amount of money every month, they can still potentially save several hundred dollars a month over the course of seven years. Because the new interest rate is determined based on current market rates, the new rate may be lower or higher than the initial one, depending on the direction of interest rates.