Mortgage Rates For a 30 Year Fixed Rate

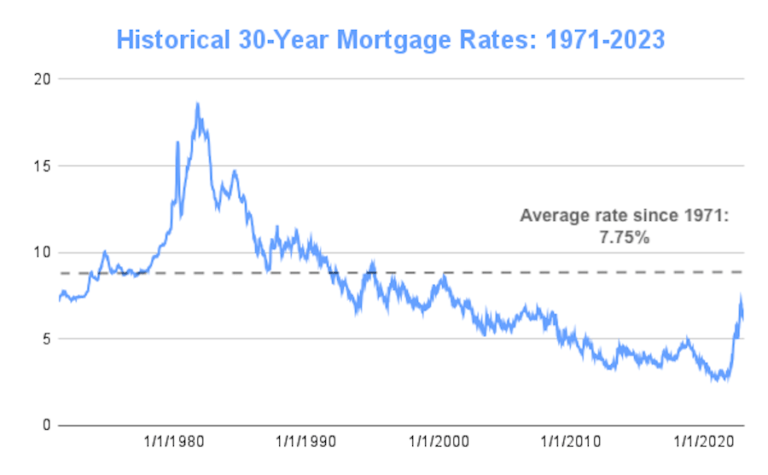

If you are considering refinancing your home, you’ve probably wondered about the latest mortgage rates. These rates have been trending upward since the Federal Reserve raised its benchmark rate on June 14. However, if you lock in a 30-year mortgage rate, you can save significant amounts of money in the long run. Mortgage rate data firm Credible has reported that, as of June 14, 30-year mortgage rates are mainly down, while 15-year mortgage rates are modestly up. Credible has received over 5,000 Trustpilot reviews with an average star rating of 4.7.

Interest rates on 30-year fixed-rate mortgages

A 30-year fixed-rate mortgage is a popular type of home loan that offers lower monthly payments over a longer term. This type of loan requires a minimum 20% down payment and a fixed interest rate. Because the term is long, the payments are low, but the interest will increase over time. This type of mortgage is ideal for those who want to budget their payments. In addition, they tend to be cheaper to obtain than other types of home loans.

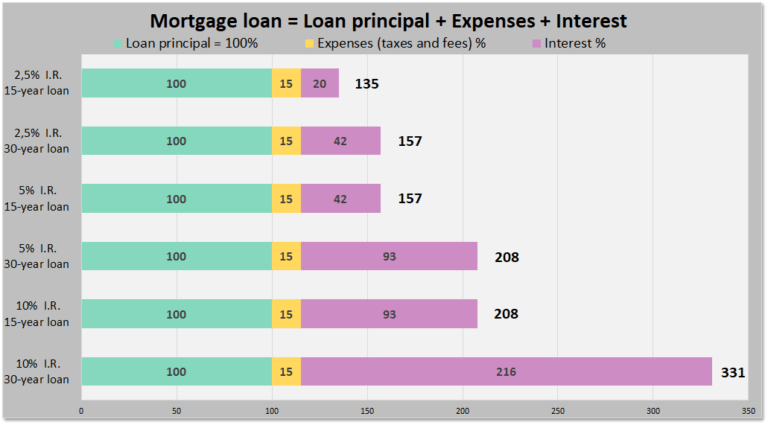

As mortgage rates continue to rise, you should keep this in mind when choosing your mortgage. A 30 year fixed-rate mortgage costs 5.23%, but that number is likely to go up next week as well. During the first three months of 2014, mortgage rates jumped about 1.5 percentage points. With these rising rates, your monthly payment will rise as well. If you’re paying 5.10%, for example, your payment will be $2,172 per month. On the other hand, if you’re paying 6%, your payment would be $2,398 per month. While the difference in monthly payments might not be much, it will add up over the course of a 30-year mortgage.

Discount points

There are several factors to consider before deciding to take advantage of discount points on a 30 year fixed mortgage rate. For example, if your loan will require at least 20% down payment, it is important to determine how much you will save by paying extra toward the principal. In addition, it is wise to consider the tax benefits of paying points as well. Buying points isn’t without risks; you may have to pay mortgage insurance to protect yourself.

Another reason to take advantage of discount points on a 30-year fixed-rate mortgage is to reduce the amount of interest paid on the loan. The lower the interest rate, the faster you’ll pay off the loan. The additional savings are reflected in the monthly payment, and the points add up quickly. If you’re planning to stay in your home for the long term, purchasing discount points may be worth the money, especially if you’re preparing to sell the property sooner than expected.

Variable-rate mortgages

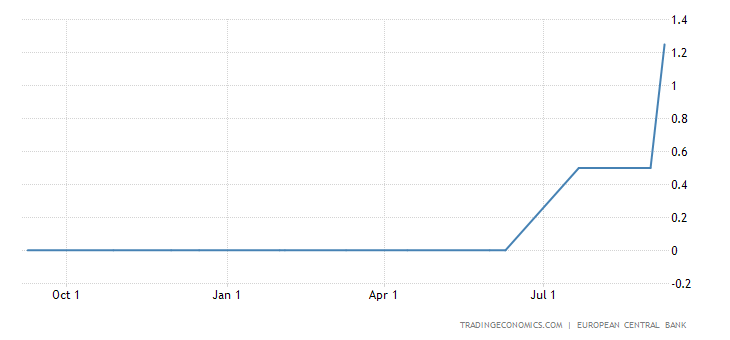

Today, the average fixed rate for 30-year fixed mortgages stands at 5.09%, the highest since last year. However, the introductory rate for a popular ARM, the 5/1 adjustable-rate mortgage, has fallen to 4.04%. Below is a line chart showing the changes in interest rates for 30 year fixed-rate mortgages and 5/1 adjustable-rate mortgages from early May to late May.

The introductory rate is typically three to seven years. In many cases, ARMs are available for up to ten years. It’s important to determine what rate will apply at the end of the introductory period. Lenders use a market index to set the interest rate, plus a margin for loan origination, so you’ll need to understand what the maximum rate is for each term.

Cash-out refinances

If you’re considering a cash-out refinance for your thirty-year-fixed mortgage, you should be aware that you’ll be paying more than you would have otherwise for the loan. While it may seem like free money, the lump-sum payment is actually just an extension of the loan, which will be bundled into the refinanced mortgage. Therefore, you should have a use for the funds right away, before deciding whether or not to take advantage of a cash-out refinance.

A cash-out refinance allows you to obtain a lower interest rate while converting some of the equity in your home into liquid cash. Unlike a normal refinance, a cash-out refinance swaps out the existing loan for a larger one, and gives you back the difference in cash. Depending on your circumstances, a 30-year fixed-rate cash-out refinance may help you make home improvements, pay off debt, or even invest the money in your home.