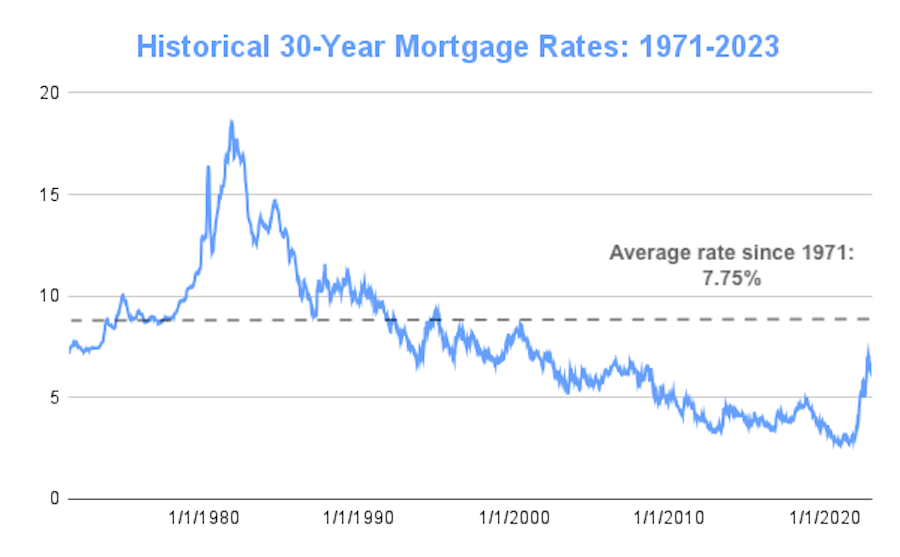

1. The current national average for a 30-year fixed mortgage rate is 6.91%. However, rates can vary greatly depending on location and lender.

2. It’s important to shop around for the best mortgage rate, as even a small difference in interest rates can save you thousands of dollars over the course of your loan.

3. When choosing a lender, consider not only the interest rate but also their reputation, customer service, and fees.

4. Factors that can affect your mortgage rate include your credit score, down payment amount, and the type of property you’re purchasing.

5. It’s also worth considering whether a shorter-term loan, such as a 15-year fixed mortgage, might be a better option for your financial situation.

6. Refinancing your mortgage can also be a way to lower your interest rate and save money. However, it’s important to crunch the numbers and consider the cost of refinancing before making a decision.

7. Don’t forget to factor in additional costs such as closing costs and property taxes when determining the affordability of your mortgage.

8. Ultimately, it’s up to you to decide what mortgage rate and lender make the most sense for your unique financial situation. Do your research, ask questions, and don’t be afraid to negotiate. [1]

In today’s market, potential home buyers can find competitive 30-year mortgage rates from a variety of lenders. With over 150,000 visitors finding their lender on one popular website alone last month, it’s clear that buyers have plenty of options to choose from.

Many lenders offer fast online processes, with opportunities to get cash towards closing or lock in your rate for 90 days. Home loan experts are available 7 days a week, ready to support buyers with a transparent rate in just a few minutes – without even pulling a hard credit score. Plus, with a range of pre-approval and VA loan options, potential home buyers can obtain a personalized rate quote within minutes.

Factors such as inflation, unemployment, and actions by the Federal Reserve all impact today’s mortgage rates, which are posted daily by most lenders. An individual’s credit score is also a key determining factor in qualifying for a favorable rate. With lenders looking for a LTV ratio, borrowers should aim for less than 80% to achieve the lowest possible mortgage rates.

The COVID-19 pandemic has continued to impact mortgage rates. In 2020, rates reached historic lows, dipping to 2.97%. As the pandemic continued into 2021, some consumers struggled to qualify for credit; however, as of September 2021, the average mortgage APR was 2.88%.

Potential home buyers can qualify for the lowest mortgage rates by putting more money towards their down payment, aiming for 20%, and doing the math before paying points. With so many options on the market for 30-year mortgage rates, it’s important to find the right lender that offers fast, transparent service and competitive rates. [1]

In the world of real estate, homeowners always want the best deal possible when it comes to their mortgages. With various lenders offering different rates and terms, it can be overwhelming to choose what suits a homeowner’s needs. However, a recent report reveals that it is a good time to buy, as there are very low competitive 30-year rates available in the market.

According to a survey, over 150k visitors found their preferred lender on a mortgage comparison website in the last month. The site gives consumers access to transparent rates in as little as three minutes without a hard credit pull, which allows consumers to compare mortgage rates effortlessly.

The current 30-year fixed purchase rate is at an all-time low, making it a good time to buy or refinance. Home loan experts are available seven days a week, making the process fast, guided, and simplified online.

The report also mentions that there are opportunities to get cash towards closing, with certified pre-approvals customized quotes available. Additionally, there are resources and learning centers to help first-time buyers navigate the home buying process.

When applying for a low-interest rate, the report advises homeowners to aim for a credit score of at least 740, which helps save money on interest. Lenders also look at the loan-to-value ratio (LTV), which represents the amount borrowed in comparison to the property value. The LTV ratio should be less than 80% to get the lowest mortgage rates.

The report also addresses the impact of COVID-19 on mortgage interest rates, with rates dipping to record lows in early June 2021. Even as the pandemic continued, rates remained steady, making it a good time to buy or refinance.

Overall, the report encourages homeowners to take advantage of these low rates and consider refinancing their mortgages, depending on their financial situation. By following key strategies like improving credit scores and aiming for a 20% down payment to lower the LTV ratio, homeowners can secure the best mortgage rates possible and feel confident in their financial future. [1]