Having an extra mortgage payment each year can help you pay off your home quicker, save you money, and avoid mortgage interest fees. To calculate how much extra you can afford to make on your mortgage, divide your monthly payment by twelve. This will allow you to shave a few years off of your loan term.

Divide your mortgage payment by 12 to shave years off your loan term

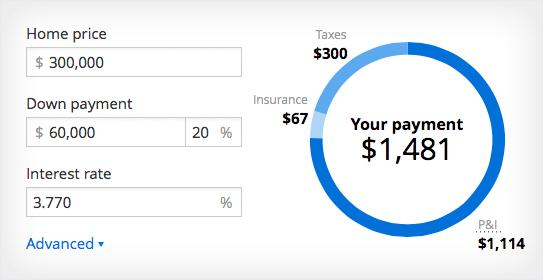

Using a mortgage calculator to figure out the best mortgage repayment plan for you is a good start. However, if you’re looking for the best way to pay off your home loan, you may have to make some sacrifices. One of the best ways to reduce your monthly payments is to make your loan payment early, preferably as close to the first of the month as possible.

The mortgage is a big part of your monthly budget, and putting some extra money towards the loan each month can pay off in the long run. The best way to do this is to use the mortgage calculator to figure out your monthly payments and then set up a savings account specifically for that purpose. Another good way to save for the mortgage is to set up a recurring deposit each month that you can use to make that extra mortgage payment. It’s also a good idea to take a look at your budget and see what your monthly cash flow is, as this will give you an idea of what your mortgage repayment plan should look like. If you’re on the fence about signing up for a mortgage loan, ask your lender for a free mortgage consultation. This way, you can get all the information you need before you make a decision, and you can avoid any unpleasant surprises down the line.

Using a mortgage calculator is a great way to figure out the best mortgage repayment plan for your family’s needs, and you can see the results in seconds. The calculator will also give you an idea of what your monthly payment will be if you wait until the first of the month, as well as a better idea of how long it will take to pay off your home loan. Once you know what your mortgage repayment plan will be, you can make sure you get a good deal, and if you’re on a tight budget, you’ll be able to make the most of your savings.

Calculate extra payments to reduce your loan term

Using a mortgage calculator to determine how much you can borrow, what your monthly payments will be and how long it will take to pay off your mortgage is an effective way to save you money and time. By knowing how much you can afford to borrow, you can determine the best repayment plan and take advantage of a better interest rate. This may include reducing your mortgage payment by a few hundred dollars a month, which can equate to thousands in interest savings. A mortgage calculator can also help you determine how long it will take you to pay off your home, assuming you follow a standard repayment plan. The mortgage calculator also allows you to see what your home is worth. This is a useful tool when selling your home. The calculator can also help you determine how much you can borrow in order to pay for the down payment.

The mortgage calculator is not for the faint of heart. You should know that you can borrow more than you actually need and that you may be overpaying. While a mortgage calculator can be overwhelming, there are several tips and tricks that will help you figure out how much you can afford to borrow, and how long it will take you to pay it off. You may even be able to refinance your mortgage in order to lower your interest rate. This can be the best way to reduce your monthly payment and save thousands in interest over the life of your loan.

There are many mortgage calculators on the market. The most popular ones allow you to calculate how much you can borrow, how long it will take to pay off your home, how much your monthly payments will be and what the interest rate is. They also provide you with a chart showing you what your home is worth. There are also several other calculators that let you compare your home’s value with the value of other homes in your area. This can be a useful tool when deciding to sell your home or refinance your mortgage.

The mortgage calculator is also useful in calculating the cost of various home improvements. For instance, if your home has a hot water heater that you have to replace every few years, this can be expensive, but you can use the mortgage calculator to figure out how much you can borrow to replace it. The calculator also helps you calculate how much you can afford to spend on other items such as windows, carpet and paint. It may be tempting to use the calculator to determine how much you can afford to spend on home improvements, but it is also useful in helping you determine what improvements are worth the money and what aren’t.

Keeping an emergency fund to pay off your mortgage

Keeping an emergency fund to pay off your mortgage can be a good idea for homeowners. An emergency fund can help keep you from taking out expensive loans to cover unexpected expenses. An emergency fund can also help protect your budget and keep you from being stressed out about a sudden loss of income or other financial trouble. It’s important to save up enough money to cover three to six months of expenses in case something bad happens.

The best way to ensure that you have enough money to keep an emergency fund to pay off your mortgage is to get a good estimate of your expenses. You can do this by setting up automatic transfers from your paycheck or checking account. Once you have the estimate, you can figure out how much money you need to save. A lot of financial experts suggest putting aside at least three months of expenses in an emergency fund. This can help keep you from going into debt to cover unexpected expenses, which can lead to bigger problems.

You can also invest extra money to earn a higher return on your money. Investing in the stock market is a good way to earn higher returns. However, you should keep in mind that the stock market is volatile. It’s also possible that you will have to sell your house to get the money you need.

Another option is to refinance your mortgage. Refinancing can lower your interest rate and decrease your monthly payments. In addition, refinancing can help you build up your emergency fund by lowering your mortgage balance. In some cases, you can even get rid of your mortgage insurance. If you have a home equity line of credit, you can use this money as an emergency fund.

You can also pay off your mortgage early. This can help you save thousands of dollars in interest over time. However, if you do decide to pay off your mortgage early, you should consult your tax advisor. You may not be able to deduct the interest you save. Also, there may be a penalty for early payoff. In addition, you may lose the opportunity to invest in the stock market and earn higher interest.

Another option is to sell your home and take out a home equity loan. If you have enough equity, you may be able to use this money to buy a cash flow-positive property. This can give you a higher return than your mortgage. However, if you have to pay off your home, you may have to start again in debt.

Paying off your mortgage early is a great way to save money, but it also means that you’ll lose out on the market’s gains. You could also lose out on the benefits of your home’s mortgage insurance if you refinance your mortgage. It may also mean that you have to pay a penalty if you pay off your mortgage before the end of the year.