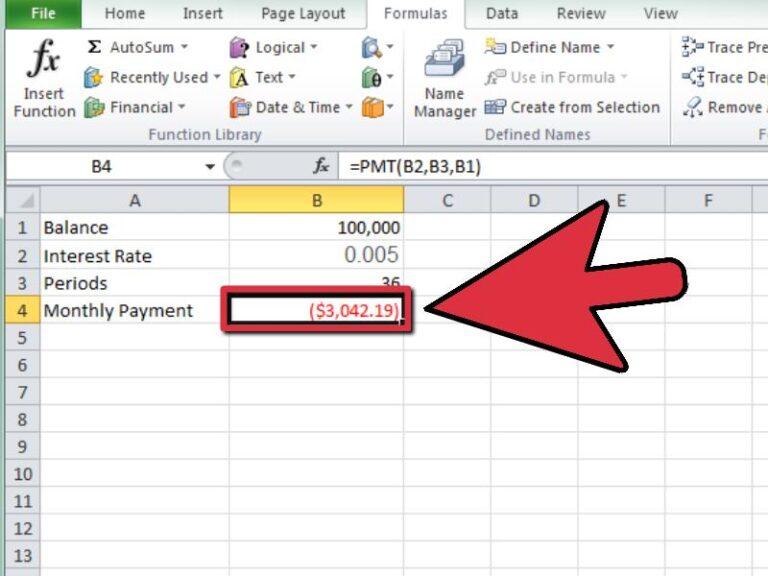

Using a Mortgage Calculator

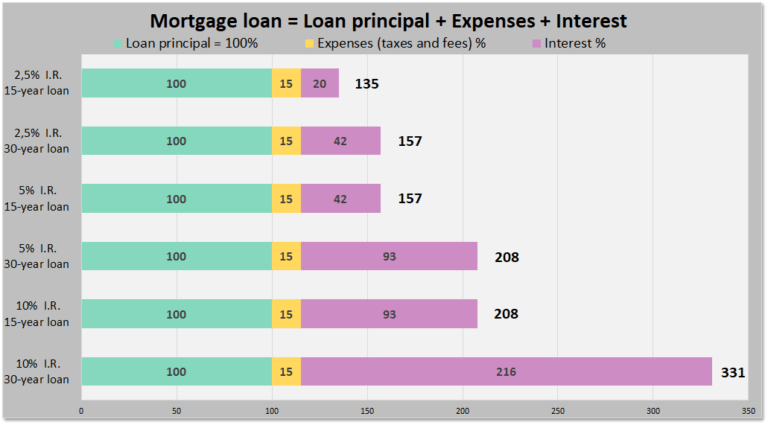

When using a mortgage calculator, there are a few things you should be aware of. The calculator should factor in ongoing taxes, homeowners insurance, and homeowners association fees, as well as property taxes and insurance premiums. In some cases, it will even include ongoing insurance premiums. To make the most accurate calculations, the calculator should…