Mortgage Rates For a 30 Year Fixed Rate

Today, mortgage rates for a 30-year fixed rate are quite competitive, but that doesn’t mean you can’t find a great deal. It all depends on your credit score and the type of loan you need. If you have excellent credit, you should get the lowest rates available. If not, you may want to shop around for another loan. If your credit score is low, you may still be able to find a good deal. To improve your credit score, try to pay off any outstanding credit card balances and make your payments on time.

Interest rate on a 30-year fixed-rate jumbo mortgage

The average interest rate on a 30-year fixed-rate, jumbo mortgage is around 5.78%, a slight increase from the previous week’s 5.33%. This rate is still well below the national average for 30-year fixed-rate mortgages, which is closer to 5.2%. Choosing a jumbo mortgage may be the right option for high-priced homes. It requires a high credit score and a good down payment.

As an individual borrower, you can get a better interest rate on a jumbo mortgage by having a higher down payment and a lower debt-to-income ratio. Although some lenders require only 10% or 20% down, you can also opt for a higher down payment and get a lower rate if you are able to contribute more money to the loan. Additionally, you can find special jumbo mortgage rates from institutions with high deposit balances and large investment portfolios.

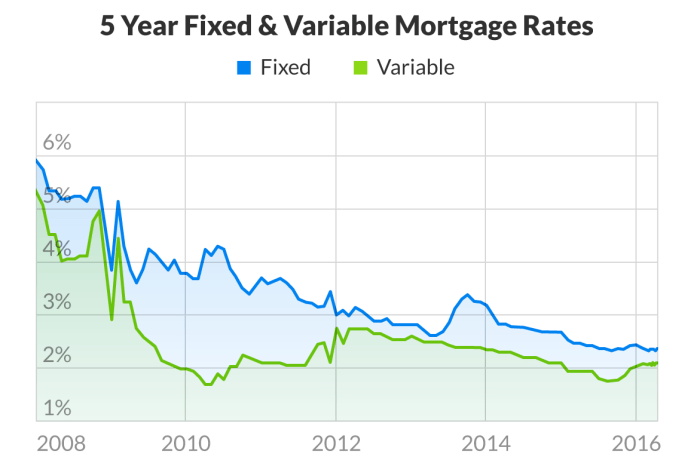

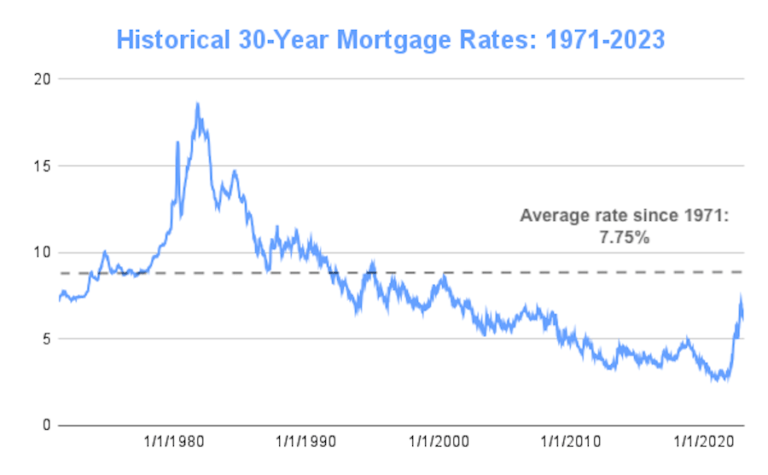

Many financial planners recommend a 30-year fixed-rate jumbola mortgage for first-time home buyers. This mortgage is typically the most affordable option for these buyers, provided that they have a good credit score and a big enough down payment. But if your situation is less than ideal, you should consider a shorter-term mortgage. A 30-year mortgage rate has generally been going down for over 40 years. However, it recently rose for a short time after the 2020 coronavirus pandemic.

Interest rate on a 15-year fixed-rate jumbo mortgage

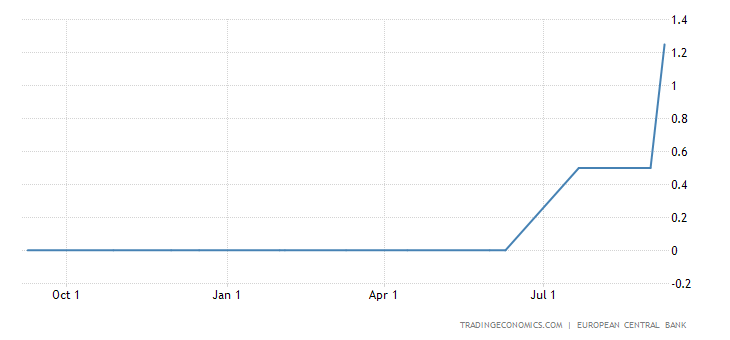

In the U.S., the Federal Reserve uses interest rates to guide the economy and control inflation. If rates drop, the Federal Reserve is trying to stimulate the economy by encouraging new purchases. When rates go up, lenders follow suit. However, a good jumbo mortgage rate depends on individual credit profiles and the size of your asset portfolio. To get the best rate, make sure your credit score is good and your debt-to-income ratio is low.

While the monthly payments on a 15-year mortgage are higher than those on a 30-year mortgage, the total interest paid will be lower because you only pay interest during the period you have owed the money. The downfall of this type of mortgage is the fact that the payments will be higher: you’ll pay back the loan in 180 installments instead of the standard 360. However, many first-time home buyers can’t afford the monthly payments and therefore might not want a 15-year mortgage.

Average rate on a 30-year fixed-rate jumbo mortgage

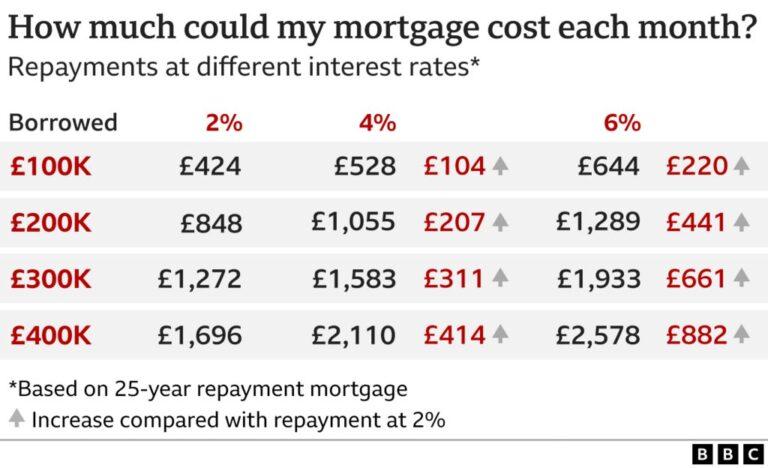

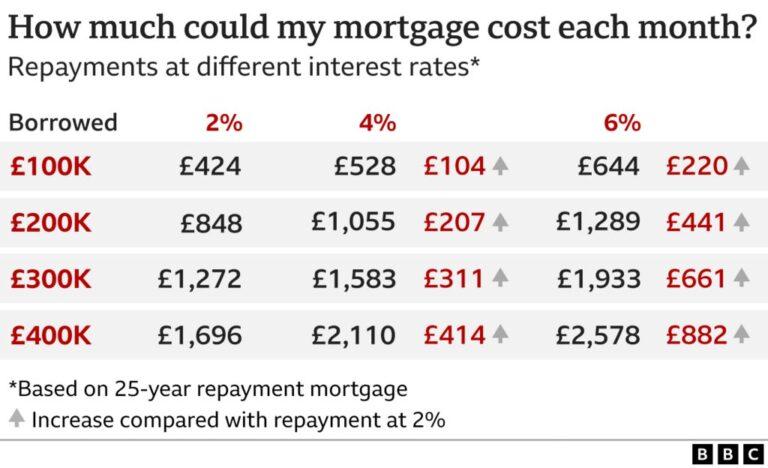

The Federal Reserve uses interest rates to regulate the economy and control inflation. A decrease in rates usually signals an attempt to stimulate the economy through new purchases. The opposite is true if the Federal Reserve raises rates. Lenders raise rates in response to changes in the Federal Open Market Committee’s rate. When the interest rates rise, lenders’ lending practices follow suit. There are several factors that determine the rate you are offered. The following table summarizes the average rates offered by lenders across the country.

A jumbo loan’s average rate is higher than a conventional mortgage. However, the rates on jumbo loans have been slightly lower since early 2022. Currently, the 30-year fixed-rate jumbo mortgage is closer to 5.2% than the national average for a 30-year fixed-rate mortgage. In other words, jumbo loans are more expensive than conventional loans.

Average rate on a 15-year fixed-rate jumbo mortgage

Despite its name, the average rate on a 15-year fixed-term jumbo mortgage is slightly higher than the national average. This is because the loan is larger and carries stricter underwriting requirements. Nevertheless, the interest rate is still lower than the 30-year fixed-rate mortgage. With a 15-year fixed-term mortgage, you will pay an average of $798 in monthly principal and $43,565 in total interest over the life of the loan.

The average rate on a 15-year mortgage is currently 5.14 percent, down 13 basis points in the last week. The lower the rate, the better, because it will save you thousands of dollars in interest over the life of the loan. However, the lower payment will force you to make larger monthly installments, which may make purchasing a more expensive home unaffordable for many borrowers.