What Are Today’s Interest Rates For Mortgages?

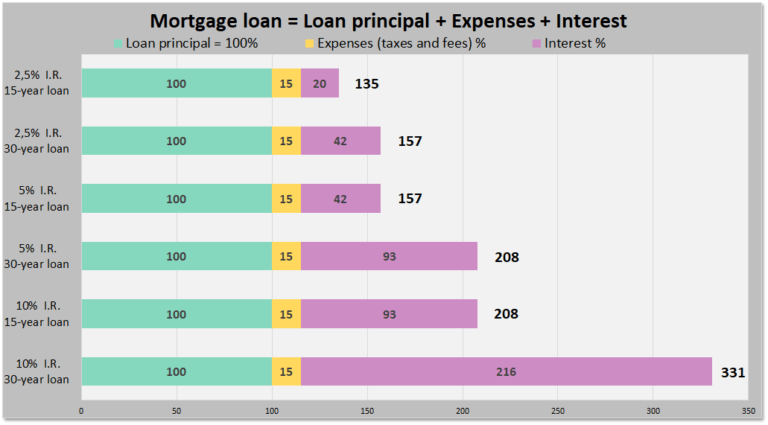

You may have been asking yourself, “What are today’s interest rates for mortgages?” It is important to remember that the interest rate you’ll pay on your mortgage is not the same as the rate you’ll pay on your down payment. In fact, the interest rate on a 30-year fixed-rate mortgage rose to 5.23% for the week ended June 9, while the interest rate on a 15-year adjustable-rate mortgage increased to 4.39%.

Average rate on 30-year fixed-rate mortgage rose to 5.23% for the week ending June 9

The average rate on 30-year fixed-rate mortgage increased to 5.23% for the week ending June 9, up from 5.09% the week prior. This increase was driven by investor concern over inflation and the impact of upcoming half-percentage point rate hike. Nevertheless, the average rate for a 30-year fixed-rate mortgage remains historically low. There are still some great deals available for those with strong credit.

The recent rise in mortgage rates has come amid expectations that the Federal Reserve will raise interest rates again this year. Currently, the central bank has five meetings left this year, and they have indicated they will hike the federal funds rate on all five. These actions are designed to balance the impact of historically high inflation in 2022, and they indirectly affect mortgage rates. For the week ending June 9, the average rate on 30-year fixed-rate mortgage increased by 14 basis points, while the rate on 15-year fixed-rate mortgage rose by 0.3 point. This jump followed a similar jump to the rate of 2.55% in the week ending June 3rd.

Average rate on 15-year fixed-rate mortgage rose to 4.49% for the week ending June 9

The increase in the average rate on 15-year fixed-rate mortgages is the result of several macroeconomic factors. The Federal Reserve has been buying billions of dollars in bonds to support the economy. While mortgage rates are not directly affected by the federal funds rate, the central bank’s bond-buying policy has been a large contributor to the low rates. On June 1, the Fed will begin reducing its balance sheet. In July and August, the amount of reductions will be identical, while in September, the taper will start.

The 30-year fixed-rate mortgage rose seven basis points to 5.48%, bringing it three-tenths of a percentage point below the peak of 5.76%, which was the highest in 13 years. The 15-year fixed-rate mortgage, on the other hand, rose 11 points to 4.84%, marking the highest level in nearly two years.

Average rate on 15-year adjustable-rate mortgage rose to 4.49% for the week ending June 9

According to the latest data from the Federal Reserve, the average rate on a 15-year adjustable-rate mortgage increased to 4.49% for the week ending June 9. This rise is a result of the recent increase in the value of the U.S. dollar. While mortgage rates are generally near historic lows, it is still important to note that the average rate is based on a borrower’s credit score and income profile. Rates may be lower or higher depending on your credit score, so you should check with your mortgage broker to find out what your rate is today.

The rates that lenders charge for a 15-year adjustable-rate mortgage are based on various factors. While they are determined by the lender, every lender uses a slightly different formula. While the prime rate is generally the benchmark for mortgage rates, lenders also use the 10-year Treasury bond yield to gauge market trends. This benchmark is a few percentage points higher than the average mortgage rate, and is the most common way to gauge mortgage rates.

Average rate on 15-year fixed-rate mortgage rose to 4.39% for the week ending June 9

In the week ending June 9, the average rate on a 15-year fixed-rate mortgage increased to 4.39%, a one-point increase from the previous week. This rate represents the average for about 200 top lenders. Buying discount points or a lower loan-to-value ratio can help you qualify for a lower rate. But if the up-front cost of discount points is greater than the savings you could make over the course of the loan, you should consider refinancing instead.

The increase in interest rates is related to several factors. One of these is the monetary policy of the Federal Reserve, which has been buying trillions of bonds to keep interest rates low. While there’s no direct link between the federal funds rate and mortgage interest rates, it certainly affects the mortgage market. On June 1, the Federal Reserve will begin reducing its balance sheet, an important step to help the housing market recover. The reductions will increase from June to July and then double in September and November.

Average rate on 15-year fixed-rate mortgage rose to 4.29% for the week ending June 9

Last week, the average rate for a 15-year fixed-rate mortgage climbed to 4.29%, up 0.8 basis point from the previous week. This is below the 13-year high of 5.16%, reached one week earlier. The average rate for a five-year adjustable-rate mortgage also rose by 0.3 basis point to 4.12 percent, up from 4.04 percent last week and 2.55 percent a year ago.

The rate rise is a result of the Federal Open Market Committee meeting, which meets every six to eight weeks. The next scheduled meeting is June 14-15. The national averages are calculated based on the lowest rates advertised by 200 top lenders. They assume a loan-to-value ratio of 80% and a FICO score of 700-760. Although the average rate may seem high, this is still a favorable rate when compared to rates that have risen in the past.