The Housing Market in Transition

The US housing market has been on a wild ride over the past few years, and the road ahead looks to be filled with both challenges and opportunities. As we look to the near future, it’s important for both prospective buyers and sellers to understand the key trends and forecasts shaping the market.

Home Prices: Moderating, But Still Rising

One of the defining features of the pandemic housing boom was the rapid appreciation in home prices across the country. In many markets, prices skyrocketed 20%, 30%, or even more in the span of just a couple years. However, that breakneck pace of price growth appears to be slowing.

In March 2024, home prices in the US were up 10.3% year-over-year. While that’s still a sizable increase, it represents a notable deceleration from the peak price growth rates seen in 2021 and 2022. Experts predict home price appreciation will continue to moderate, with annual gains likely in the low to mid-single digits over the next 5 years.

This means the days of homes selling for tens of thousands over asking price may be coming to an end. But it doesn’t mean the housing market is about to crash. Prices are still rising, just at a more sustainable pace.

“The frenzy of the pandemic housing boom is starting to cool, but this is more of a transition to a more balanced market, not a collapse,” explains Jessica Chen, a real estate agent in Los Angeles. “Buyers will still face challenges, but they may have a bit more breathing room and negotiating power than they did a couple years ago.”

Mortgage Rates: Inching Down, But Remain High

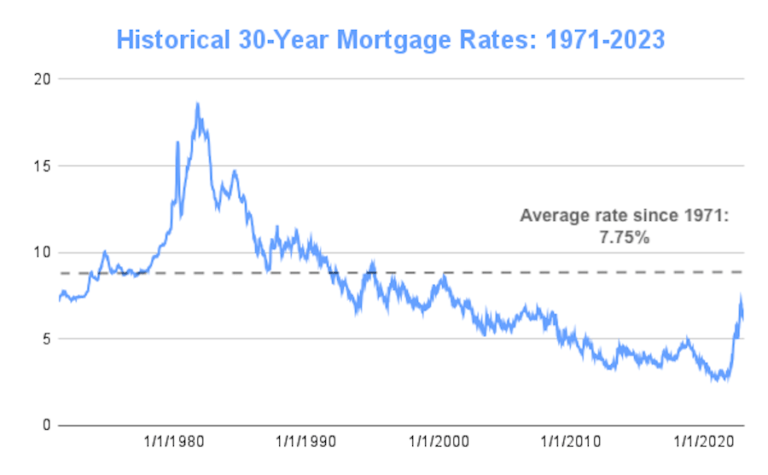

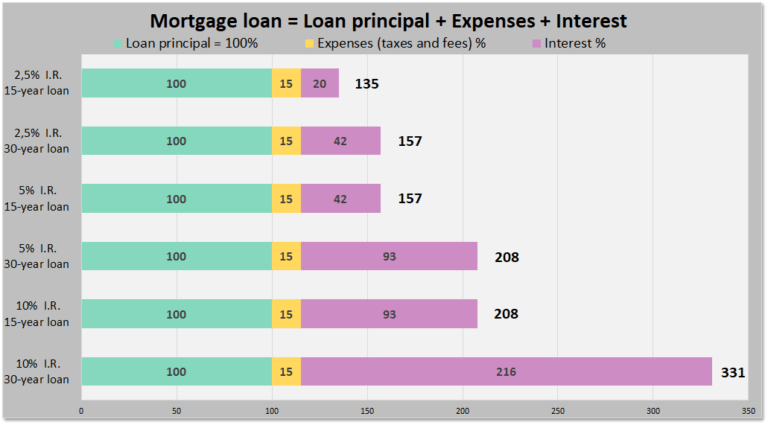

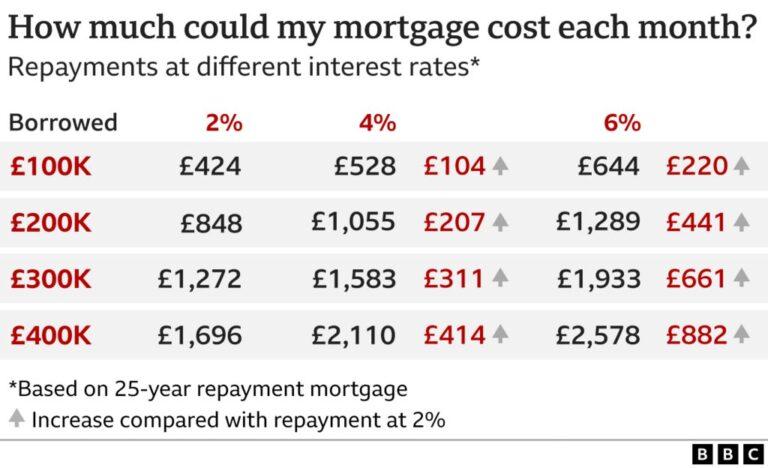

Another major factor shaping the housing market is the sharp rise in mortgage rates over the past year. After hitting historic lows below 3% during the pandemic, rates on 30-year fixed mortgages have now climbed to around 7%. This has had a significant impact on affordability, pricing many buyers out of the market.

The good news is that mortgage rates are expected to come down from these elevated levels, potentially reaching the low 6% range by the end of 2024. However, a return to sub-3% rates anytime soon seems highly unlikely.

“Buyers need to mentally prepare for mortgage rates to remain high, at least in the near term,” says Chen. “Even if they come down a bit, 6% is still quite a bit higher than what we saw just a couple years ago. This is going to be an ongoing challenge for affordability.”

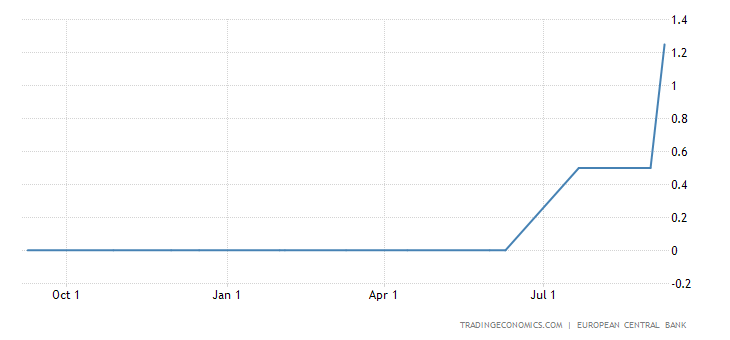

The Federal Reserve is not expected to cut interest rates until at least June 2024, and even then, the rate cuts may be more modest than previously anticipated. This suggests mortgage rates will likely stay elevated for the first half of 2024.

There is a possibility rates could see a small 0.125-0.25% reduction after the Fed’s April 2024 meeting, but this would only be a modest decline. Adjustable-rate mortgages may see increased demand as fixed rates remain high, but the 30-year fixed-rate mortgage is still expected to be the dominant product.

Inventory: Slowly Improving, But Tight

Another major dynamic in the housing market has been the severe shortage of homes for sale. During the pandemic, inventory plummeted to record lows as demand surged and sellers were hesitant to list their homes.

As of March 2024, there was only a 2.9-month supply of homes on the market, well below the 5-6 months considered a balanced market. This tight inventory has fueled intense competition among buyers and driven prices higher.

However, there are signs that inventory may start to improve in the coming months and years. More sellers may list their homes as life circumstances change, and new construction could also boost the number of homes available.

“We’re starting to see a gradual increase in the number of homes for sale, but it’s still a very tight market,” says Chen. “Buyers need to be prepared to move quickly and potentially face multiple offer situations, even if the frenzy has cooled a bit.”

Experts predict housing inventory will gradually increase, but it may take time to reach more balanced levels. In the meantime, the market will likely remain competitive for buyers, though not quite as cutthroat as the pandemic peak.

Buyer Demand: Easing, But Still Strong

The pandemic housing boom was fueled by a surge in buyer demand, as low rates, remote work flexibility, and a desire for more space drove hordes of buyers into the market. This intense competition led to bidding wars, homes selling well above asking price, and buyers waiving contingencies just to get an offer accepted.

While buyer demand remains strong, there are signs it may be starting to ease. In March 2024, over 46% of homes were still selling above list price, but this was down from the 60%+ levels seen during the height of the frenzy. The percentage of homes with price drops has also increased slightly, suggesting the market is starting to cool.

“We’re definitely seeing a shift in the market, where buyers have a bit more negotiating power than they did a couple years ago,” says Chen. “But it’s still a very competitive environment, and sellers still have the upper hand in most cases.”

Experts predict buyer demand will remain elevated, but may start to moderate as higher mortgage rates and home prices price out some prospective purchasers. The market is likely to transition to a more balanced state, with less intense competition, but still strong overall demand.

Implications for Buyers

For prospective homebuyers, the current housing market landscape presents both challenges and opportunities. On the one hand, affordability remains a significant hurdle, with high prices and mortgage rates squeezing many buyers out of the market.

“Buyers need to be realistic about what they can afford and what compromises they may need to make,” advises Chen. “It’s important to get pre-approved for financing, understand your budget, and be prepared to act quickly when the right home comes on the market.”

At the same time, the moderation in price growth and the potential for mortgage rates to come down a bit offer some glimmers of hope. Buyers may have a bit more breathing room and negotiating power than they did during the height of the pandemic frenzy.

“The key is to be patient, do your research, and work closely with a knowledgeable real estate agent who can help you navigate the process,” says Chen. “It may take some time and persistence, but there are still opportunities out there for buyers who are prepared and flexible.”

Implications for Sellers

For home sellers, the current market conditions present a mixed bag. On the one hand, prices are still rising, and there is still strong buyer demand, albeit not at the fever pitch of the pandemic boom.

“Sellers are still in a good position, but they need to be realistic about pricing and manage their expectations,” explains Chen. “The days of homes selling tens of thousands over asking with multiple offers may be behind us, but sellers can still command a premium in most markets.”

At the same time, the gradual increase in inventory and moderation in buyer demand means sellers will need to be more strategic in their approach. Pricing homes competitively, being flexible on contingencies, and working closely with an agent will be key to a successful sale.

“Sellers need to understand that the market has shifted, and they may not be able to call all the shots like they could a couple years ago,” says Chen. “But if they price their home right and work with a knowledgeable agent, they can still achieve a great outcome.”

Overall, the housing market is in a state of transition, with both challenges and opportunities for buyers and sellers. Prices are still rising, but at a slower pace, while mortgage rates are expected to gradually come down from their current elevated levels. Inventory is slowly improving, but will likely remain tight, and buyer demand, while easing, is still strong.

The key for both buyers and sellers is to stay informed, work with experienced real estate professionals, and be prepared to adapt to the evolving market conditions. With the right strategy and mindset, it is possible to navigate the current housing landscape and achieve your real estate goals.