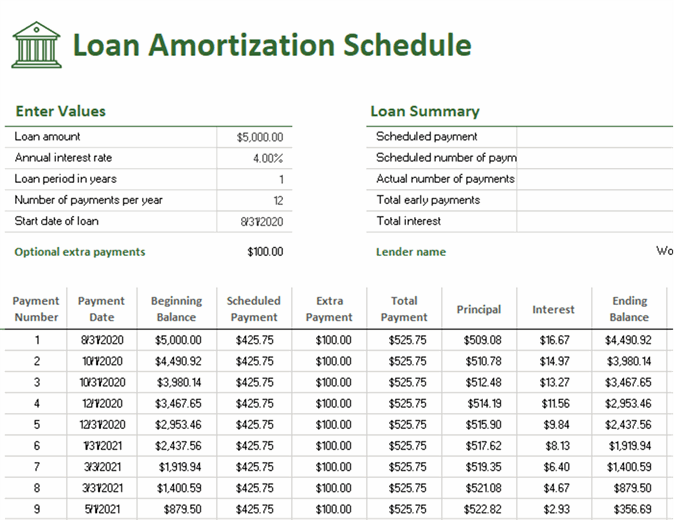

A Loan Amortization Schedule is a statement of monthly payments that a borrower makes throughout the life of the loan. It shows the scheduled payment amounts for every month of the loan and shows how each payment will affect the principal balance. In addition to the scheduled monthly payments, the amortization schedule also shows the interest rate on the loan, which is based on the most recent balance of the loan. The lower the principal balance, the lower the interest rate.

Calculator

A loan amortization calculator determines periodic payments on a loan. It uses the amortization process to determine the amount of money to be paid every month or quarter. The calculator helps you understand how the loan amortization process works and how long it will take to pay off the loan. It can also help you plan a budget based on the payments you can afford.

To use a loan amortization calculator, enter the loan date and the payment frequency. You can enter up to eleven different payment frequencies. You can also enter extra payments each month. The amortization table will update with each extra payment. Once you’ve input the data, you can print out the results.

A loan amortization calculator will determine how much money to pay each month based on the loan’s interest rate and principal balance. It will also estimate the total amount of interest that you’ll pay and the remaining balance at the end of the loan term. You can change any of the parameters to determine how much money you can afford to pay each month.

Template

A good template for loan amortization can be a simple and effective tool for tracking your financial obligations. It can be customized for any loan term up to 30 years and requires very little input from you. The template has automated calculations that will help you figure out the principal and interest payments each month. You can also add color and other design elements to make your amortization schedule more appealing and easy to read.

When you’re creating a loan amortization schedule, the first step is to choose a formula. You’ll want a formula that will calculate interest, principal, and extra payments for your loan. Make sure to include absolute or relative cell references for your Loan term and Payments per year cells. Use mixed cell references for Period 1 and make sure to use relative rows and columns. Once you’ve entered the formulas, you’ll want to wrap the formulas in an IFERROR function to avoid various errors and ensure accuracy.

The next step is to copy the formulas into the appropriate cells. This will ensure that the formula is consistent throughout the table. Otherwise, you may end up with rows with period numbers that don’t correspond to the actual payments. If you’re not too concerned with precision, you can skip this step and use a conditional formatting rule to hide unused periods.

Using an amortization schedule

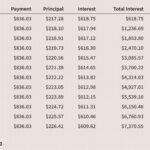

Using an amortization schedule for a credit card or loan can make it easy to understand the total impact of the loan. It will show your payments in standardized terms, allowing you to easily budget your monthly payments. The amortization schedule will also include the total principal and interest payments of your loan, making it easier to understand what the total repayment amount will be.

An amortization schedule is a table that shows all of your payments and the balance of the loan over time. It will list the total payment amount and the percentage of the payment that will be applied to the principal and interest. When you first receive a loan, you should look at this chart to get a clear picture of how much you will have to pay over the course of the loan.

An amortization schedule can also help you adjust the payment timeline for your loan. It can encourage you to make extra payments toward principal, which will reduce the total interest owed in the future. A small extra payment can mean big savings.

Using a payment schedule

When using a payment schedule for loan amortization, you need to consider the different methods of amortization and the costs associated with each. One way is to make a payment at the beginning and end of each period of the loan. This will help you stay current with your payments and build your business credit history.

Another way is to calculate the total number of payments you’ll make throughout the loan’s life. To calculate this, you can use an amortization schedule, which shows you the estimated payment amounts and how much is being paid towards each principal and interest payment. The amortization schedule should also indicate what percentage of each payment is being applied to interest and principal.

If you are considering a loan, you may not know how much you need to borrow and how much interest you’ll have to pay. Once you have this information, you can create a payment schedule. This way, you can see how much you will need to pay each month. By knowing the amount of interest you’ll have to pay each month, you can make extra payments of principal to reduce your interest payments.