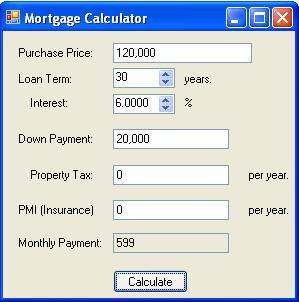

How to Use a Mortgage Calculator

A mortgage calculator helps you calculate various factors of a loan, including the interest rate, down payment, and loan term. It can also help you decide the best length of the loan. In addition to these, property taxes are also considered. These taxes cover a range of expenses that are local to your area. Nationally, property taxes run around $3,000 per year, or just over one percent of the assessed value of the home. However, this amount can vary from area to area, and is an important factor to consider when calculating the loan.

Components of a mortgage calculator

A mortgage calculator can help you figure out your monthly payment, the interest you will pay over the life of the loan, and extra payments. Extra payments are those extra payments that you may want to make on top of your monthly payment. These payments will decrease the loan balance, and lower your interest rate. If you can afford extra payments, you can pay off your mortgage earlier than you originally planned. Mortgage calculators can help you determine the best extra payment amount.

A mortgage calculator allows you to input information such as interest rate, payment frequency, and down payment. It also lets you enter the number of years you’d like the loan to last. It will calculate the monthly payment, including all the other costs of the mortgage, such as taxes and insurance. Then, you can analyze the results. Once you’ve compared the results of the various calculators, you can choose which mortgage rate and payment plan work best for your needs.

Interest rate

Most mortgages require a down payment. This amount can be as low as 3%, depending on the type of loan you choose and your credit score, but most financial experts recommend a down payment of 20% or more. Another consideration is the length of the loan. The longer the loan term, the lower your monthly payment, but the higher your overall interest costs. A shorter-term loan has higher monthly payments, but lower overall interest costs.

The next factor to consider when calculating a mortgage payment is the interest rate. The interest rate is the amount of money a lender will charge you for the loan, and the higher the interest rate, the higher the monthly payments. A mortgage calculator can show you how much house you can afford, along with your monthly payments and overall expenses. Although a larger down payment will cost more today, it will pay off in the long run, since you’ll be saving money every month.

Loan term

The amount of payments you can expect to make over the term of the mortgage is represented by the loan term. The calculator will display the years needed to repay the loan, and you will make monthly payments throughout that term. To determine the number of payments you can expect, multiply the loan term by 12. For example, a 30-year loan divided by twelve payments per year equals 360 total payments. Keep in mind that the loan term does not include any extra payments that you will make to third parties or other costs of home ownership.

The length of a loan will affect the size of your monthly payment, as well as the total amount of interest that you will pay. A longer loan term is usually associated with a higher interest rate. You can use an interest rate explorer to estimate interest rates on different loans. However, it is important to note that the interest rate may not be the same on every mortgage. In some cases, the longer the term, the lower the rate will be.

Down payment

When determining your affordability, it’s useful to use a mortgage payment calculator to determine your down payment percentage. You can enter the price of a home and your monthly rent payments to get a rough estimate of how much you can afford to put down. A mortgage payment calculator is a helpful tool because it makes all the necessary assumptions for you. It can also be useful when calculating how much down payment you should have. A down payment of ten percent will lower your monthly payments significantly.

A down payment is only one of the costs that you will have to pay upfront during the purchase of a home. Other expenses include mortgage insurance and points on the loan. Other fees may be required, such as a survey, appraisal, or inspection. Closing costs are typically between two and five percent of the purchase price of the home. To minimize your overall mortgage payment, you can use a mortgage calculator to determine what you can afford.